>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

Sorry Barney not trying to hijack...

Will keep updating as the month goes on.

had a few loses in a row but made them back... same old trading the GJ sold the aud but closed it as it really is not with my plan so it shouldn't have happened.

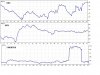

have a sell open looking for a base to crack, still some buyers on it so will keep holding till market proves me right or wrong... most trades atm will be .05, exciting i know. but at 10% in front i normally cut the size.

sell not looking so good atm might be buying later tonight.

Will keep updating as the month goes on.

had a few loses in a row but made them back... same old trading the GJ sold the aud but closed it as it really is not with my plan so it shouldn't have happened.

have a sell open looking for a base to crack, still some buyers on it so will keep holding till market proves me right or wrong... most trades atm will be .05, exciting i know. but at 10% in front i normally cut the size.

sell not looking so good atm might be buying later tonight.