- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

Silver - 19 August 2011

================================

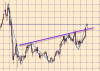

Silver is braking the neck line of the Head& Shoulders pattern, if monday silver closes high with a good volume, target could be around $50.00 .

View attachment 44143

Now, silver had a pullback to the neck line after breaking up that in a mentioned Tilted H&S, Target would be around $50.00