- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

Australian Dollar …. (a no-brainer trade set up ? )

Last week ….W hile the whole world of traders out there are watching the stock-market and wondering Which Way is Up …

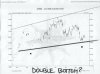

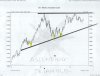

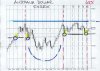

Just look at what the Australian dollar has been up to … It basically has been quietly forming a base ,,, while m ost eyes are on Stocks ,,,, I’ve seen this movie before and and I didn’t like it last time around … This one looks like its going to sneak up on a lot of people ….

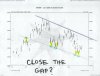

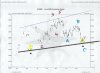

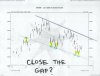

These chart formations are a base on Daily charts ,, I didn’t even look at the longer term weekly charts ,, in order to see what’s really going on yet /…. Because this one is in some kind of channel and it has not 1 but 2 overhead gaps …. This is an instance where the futures traders who ‘s eye is well trained and have lost enough money in the markets, such as myself , can really sit back and see the importance of these overhead gaps …

Clearly, you can clearly see that if you trade FOREX ,

These gaps are not apparent to the intraday traders out there …. They are blind to this fact …..

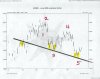

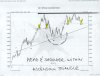

Talk about risk to reward , look at the 2nd chart posted here… this market the Australian Dollar , has multiple support ….

And its happened quite a few times …. The way I am thinking about this one is ,,, What is the probability of this going back up to the .7800 area ? Well , I really don’t care to calculate it,,, because placing a stop just under .7500 looks like it could hold up moving forward …

Next , week any pull back in the Us Dollar should cause a rally here ( futures contracts ) …. Lets watch and see ,,,,

Any comments ? ………….

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliot Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

Last week ….W hile the whole world of traders out there are watching the stock-market and wondering Which Way is Up …

Just look at what the Australian dollar has been up to … It basically has been quietly forming a base ,,, while m ost eyes are on Stocks ,,,, I’ve seen this movie before and and I didn’t like it last time around … This one looks like its going to sneak up on a lot of people ….

These chart formations are a base on Daily charts ,, I didn’t even look at the longer term weekly charts ,, in order to see what’s really going on yet /…. Because this one is in some kind of channel and it has not 1 but 2 overhead gaps …. This is an instance where the futures traders who ‘s eye is well trained and have lost enough money in the markets, such as myself , can really sit back and see the importance of these overhead gaps …

Clearly, you can clearly see that if you trade FOREX ,

These gaps are not apparent to the intraday traders out there …. They are blind to this fact …..

Talk about risk to reward , look at the 2nd chart posted here… this market the Australian Dollar , has multiple support ….

And its happened quite a few times …. The way I am thinking about this one is ,,, What is the probability of this going back up to the .7800 area ? Well , I really don’t care to calculate it,,, because placing a stop just under .7500 looks like it could hold up moving forward …

Next , week any pull back in the Us Dollar should cause a rally here ( futures contracts ) …. Lets watch and see ,,,,

Any comments ? ………….

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliot Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …