RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

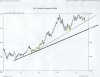

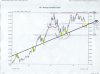

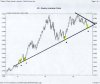

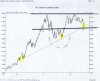

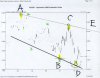

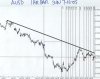

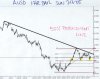

Re: Australian Dollar …. (a no-brainer trade set up ? )

I think this is the issue here, we seem to be at cross purposes. This is not to hassle you MW, just to get an idea of how you apply your work in real life, as TechA says we're not sure if you took the trade and if so where and how etc. The numbers will tell it.

Well I've posted very specific info on entry/exits/stops in some trades, but not all. That is because, as I freely admit, I'm a newbie and I'm still learning, so I don't have a solid theory to promote. Also I don't trade that often and I don't have time to post at every step. One trade where I was very specific is the Destra thread: https://www.aussiestockforums.com/forums/showthread.php?t=578&highlight=destra Also some others but I don't think there was as much detail. My most recent trade is my PRK trade https://www.aussiestockforums.com/forums/showthread.php?t=1364&page=3, I'll post my entry (actual figures from before I placed my order). Hope that gives an idea of what is expected. TechA has also traded a few recently with clear stops, entry signals etc stated, see here: https://www.aussiestockforums.com/forums/showthread.php?t=1385&page=1&pp=10.

So maybe we can now get back to this promising pattern in the Aussie dollar...maybe you'd like to provide links to some of your earlier threads techA if you'd like to illustrate some points on risk and mm which you think have not been covered by MW and we can debate it in that thread??

Also, these technical debates can get heated but remember the object is to analyse each others methods and views rather than to just disagree so let's keep the debate robust rather than rowdy. So far so good.

tech/a said:Waves.

As it is I cant tell wether your taking a trade or waiting for a setup to pan out---in which case Id like to see when you would take a trade---out of interest for your charting.

Is it that hard or am I being un reasonable?

I think this is the issue here, we seem to be at cross purposes. This is not to hassle you MW, just to get an idea of how you apply your work in real life, as TechA says we're not sure if you took the trade and if so where and how etc. The numbers will tell it.

Well I've posted very specific info on entry/exits/stops in some trades, but not all. That is because, as I freely admit, I'm a newbie and I'm still learning, so I don't have a solid theory to promote. Also I don't trade that often and I don't have time to post at every step. One trade where I was very specific is the Destra thread: https://www.aussiestockforums.com/forums/showthread.php?t=578&highlight=destra Also some others but I don't think there was as much detail. My most recent trade is my PRK trade https://www.aussiestockforums.com/forums/showthread.php?t=1364&page=3, I'll post my entry (actual figures from before I placed my order). Hope that gives an idea of what is expected. TechA has also traded a few recently with clear stops, entry signals etc stated, see here: https://www.aussiestockforums.com/forums/showthread.php?t=1385&page=1&pp=10.

So maybe we can now get back to this promising pattern in the Aussie dollar...maybe you'd like to provide links to some of your earlier threads techA if you'd like to illustrate some points on risk and mm which you think have not been covered by MW and we can debate it in that thread??

Also, these technical debates can get heated but remember the object is to analyse each others methods and views rather than to just disagree so let's keep the debate robust rather than rowdy. So far so good.