>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

If you are doing international TT's and >50k pa AUD worth PM me and i should be able to help you out, i work for a non-bank

Thanks for the heads up Pawn, I will see where the AUD is in a weeks time.

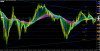

Today's gamble trade.

Long on the AUDUSD, very small position as its a counter trend trade.

we had a pin bar on the 5/10 with inside bar after today's opening hour. looking for a rally to the 21ema or a low run and stop out.