I'm newish to AED. Only in the last 6 months but think any business with shares valued at $2 odd vs a price of $1 odd seems a good buy. Is this too simplistic? Why isn't the price going up, especially now that the company is buying its own shares back?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AED - AED Oil

- Thread starter lewstherin

- Start date

rub92me

Don't look back

- Joined

- 24 April 2006

- Posts

- 1,071

- Reactions

- 6

The price of oil dropping from USD145 to USD40 didn't exactly help their profitability. For the rest of the saga: have a good read through this thread for starters...

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

I'm newish to AED. Only in the last 6 months but think any business with shares valued at $2 odd vs a price of $1 odd seems a good buy. Is this too simplistic? Why isn't the price going up, especially now that the company is buying its own shares back?

If the price is $1 then that is what its value is, the value assigned to it by the market is what counts, not some hypothetical NTA.

Yes, I agree in principle, but AED has about 300 million in the bank and only 150million shares. Am I wrong in thinking that would mean that IF I had 150million dollars I could buy the whole company and then pay myself back from their (now my) cash and still have 150mill left over?? Surely someone like cashed up (like BHP) will eventually see this and buy them up??

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

The market is anticipating that they will blow this cash/not put it to good use, and managements track record doesnt exactly help with the credibility.

Also, it would take much more than just the current MC to buy the stock, as not everyone would be willing to sell at this price, so the offer would probably have to be 200 or even 250 million, although if someone lobbed an offer i would doubt they would actually get it below cash value, because no one would be willing to sell, therefore th offer would not get the 80 or 90% acceptance required.

Also, it would take much more than just the current MC to buy the stock, as not everyone would be willing to sell at this price, so the offer would probably have to be 200 or even 250 million, although if someone lobbed an offer i would doubt they would actually get it below cash value, because no one would be willing to sell, therefore th offer would not get the 80 or 90% acceptance required.

If you read their September quarterly report, you will notice that they did not explain at all how and why they spent 14.6 million dollar cash on production. Yet the incoming cash (revenue from production) for that quarter was only 15 million. Does anyone know why they spent that much? I am a newbie to shares by the way.

chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

Because they are incompetent.If you read their September quarterly report, you will notice that they did not explain at all how and why they spent 14.6 million dollar cash on production. Yet the incoming cash (revenue from production) for that quarter was only 15 million. Does anyone know why they spent that much? I am a newbie to shares by the way.

They rooted the start up, ignored specialist consultants, tried to cut corners to get cheaper production in the beginning.

But they rogered it, despite all the advice they ignored.

And I doubt their production costs are much lower than the POO, because the ongoing maintenance for the short cuts they went for must be massive.

- Joined

- 1 February 2007

- Posts

- 1,068

- Reactions

- 0

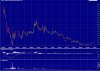

Well guys even though this has been a dog of a stock with incompetent management, the price of oil is helping their sp.

90c looks like its a good base and with oil prices on the way up, so is AED.

They are producing oil (less than they should be unfortunately) and have a drilling plan in place for 09, cash in the bank...so we could start to see a steady increase in the co's share price for the 2009 year

Volume is WAY off though

90c looks like its a good base and with oil prices on the way up, so is AED.

They are producing oil (less than they should be unfortunately) and have a drilling plan in place for 09, cash in the bank...so we could start to see a steady increase in the co's share price for the 2009 year

Volume is WAY off though

Attachments

michael_selway

Coal & Phosphate, thats it!

- Joined

- 20 October 2005

- Posts

- 2,397

- Reactions

- 2

Well guys even though this has been a dog of a stock with incompetent management, the price of oil is helping their sp.

90c looks like its a good base and with oil prices on the way up, so is AED.

They are producing oil (less than they should be unfortunately) and have a drilling plan in place for 09, cash in the bank...so we could start to see a steady increase in the co's share price for the 2009 year

Volume is WAY off though

yeah not bad today

Earnings and Dividends Forecast (cents per share)

2008 2009 2010 2011

EPS 17.4 -11.9 33.3 71.2

DPS 0.0 0.0 0.0 0.0

thx

MS

The next question is can AED continue to climb in the shorter term? My EW count has the stock firmly entrenched in a larger corrective A, B, C pattern of a likely larger (A), (B), (C) meaning longer term it still looks bleak. There is scope for continued upside shorter term however maybe even to $3.60. Some nice divergence in MACD between lows in Feb and Nov last year.

Attachments

I've been away from this one for some time (busy watching the world meltdown). I'm still holding a few of these and wonder if someone can kindly summarise where the hell AED has got to? Clearly it is a dog of a stock and clearly the management are a bunch of losers but is there any silver lining? Net effect of the Sino JV seems to be zero? Is there any chance of increasing production rates? Is there any hope of finding a vast new well in the Puffin field. Do we have anything going for us or shall I stuff these under the mattress. The last few I hold I bought at $1.80 - if I could get that back and slink off quietly I'd be happy.

- Joined

- 24 December 2008

- Posts

- 130

- Reactions

- 0

don't directors own a lot of this stock....

could there be another dividend announced?

---

---

---

could there be another dividend announced?

---

---

---

- Joined

- 30 November 2007

- Posts

- 18

- Reactions

- 0

..... I would wait a little while longer. This stock has some way to go and with a little patience you might be able to pick it up at around 10 cents. The new Chinese partners are already thrilled with this Aussie icon. At first they did not know the meaning of the word 'puff', but I believe that someone has now provided some explanation and a context in which it may be used: "Up in a puff of smoke".

Well, based on their quarterly, they produced just over 2000 bopd in the Dec qtr, which is pretty crap if you ask me I thought they were producing around 4-5 thousand a day but well short of that.

I thought they were producing around 4-5 thousand a day but well short of that.

I do like the fact that they have enough storage capacity in the FPSO to avoid these ridiculously low oil prices, with 400k barrels in stock - and the fact that they still have about $1.60 per share CASH, which makes me think that I might hang on for a bit longer

I do like the fact that they have enough storage capacity in the FPSO to avoid these ridiculously low oil prices, with 400k barrels in stock - and the fact that they still have about $1.60 per share CASH, which makes me think that I might hang on for a bit longer

- Joined

- 1 February 2007

- Posts

- 1,068

- Reactions

- 0

the fact that they still have about $1.60 per share CASH

Thats interesting isn't it. im glad you brought that up.

It must be doing a CFE (Cape Lambert Iron).

Its sp fell like a rock and was well below their cash per share basis.

Now look at it from where it was. Not sure if its on par or not now. I'll shuffle over to the CFE thread and ask that

Down side is...AED breaking 90c support level is not good.

Probably best to wait for oil prices to rise again..then maybe AED will have to play catch up to the cash backing

- Joined

- 13 July 2008

- Posts

- 170

- Reactions

- 0

aed blunder...

yeah... And I could get BHP for 25cents...

come on man...

get real...

.^sc

yeah... And I could get BHP for 25cents...

come on man...

get real...

.^sc

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Hey guys, well I was speaking with an old investment mate of mine and he brought AED to my attention yesterday

To be honest never really looked at the company because I played its main Puffin project through the royalty NWE was to recieve

Anyhoo a quick look confirmed the following

AED

Shares: 155m

Cash $270m

Obligations: $200m (Tax referbishment development etc etc)

So nothing really to get excited about except the fact that SIPC paid $560m US (in much much more buoyant times) for 60% of AED's projects, which would say that the balance 40% AED owns is worth $375m US which at 0.66 AUD/USD = $570m AUD approx = $3.67 a share AED

Given the current melt down lets assume SIPC would only be willing to 1/4th to a half of what they originally paid for the balance 40%

That means assuming they wanted to SIPC could offer 90c - $1.80 for AED

Now alot of this depends on if SIPC actually wants the remaining 40%, also I think at current Oil Price levels the project is marginal at best but I am a firm believe in the Peak Oil theory and hence believe this oil price is just a blip and think $60-$80 is a much more reasonable medium term price

Anyhoo I'm in at 61c for a punt

thoughts?

To be honest never really looked at the company because I played its main Puffin project through the royalty NWE was to recieve

Anyhoo a quick look confirmed the following

AED

Shares: 155m

Cash $270m

Obligations: $200m (Tax referbishment development etc etc)

So nothing really to get excited about except the fact that SIPC paid $560m US (in much much more buoyant times) for 60% of AED's projects, which would say that the balance 40% AED owns is worth $375m US which at 0.66 AUD/USD = $570m AUD approx = $3.67 a share AED

Given the current melt down lets assume SIPC would only be willing to 1/4th to a half of what they originally paid for the balance 40%

That means assuming they wanted to SIPC could offer 90c - $1.80 for AED

Now alot of this depends on if SIPC actually wants the remaining 40%, also I think at current Oil Price levels the project is marginal at best but I am a firm believe in the Peak Oil theory and hence believe this oil price is just a blip and think $60-$80 is a much more reasonable medium term price

Anyhoo I'm in at 61c for a punt

thoughts?

Hey welcome back bro,

Long time.

I played them both :

:

While I agree with your analysis (its all based on fact so cant disagree really) i think its important to keep in mind that its not a bullmarket anymore AND even in a bullmarket, these valuation plays don't always work out.

As an example, Do you remember JRL and EME?

Whats a punt exactly? 500k shares? :

:

Good to see you back here.

Long time.

To be honest never really looked at the company because I played its main Puffin project through the royalty NWE was to recieve

I played them both

YOUNG_TRADER said:Anyhoo a quick look confirmed the following

AED

Shares: 155m

Cash $270m

Obligations: $200m (Tax referbishment development etc etc)

So nothing really to get excited about except the fact that SIPC paid $560m US (in much much more buoyant times) for 60% of AED's projects, which would say that the balance 40% AED owns is worth $375m US which at 0.66 AUD/USD = $570m AUD approx = $3.67 a share AED

Given the current melt down lets assume SIPC would only be willing to 1/4th to a half of what they originally paid for the balance 40%

That means assuming they wanted to SIPC could offer 90c - $1.80 for AED

Now alot of this depends on if SIPC actually wants the remaining 40%, also I think at current Oil Price levels the project is marginal at best but I am a firm believe in the Peak Oil theory and hence believe this oil price is just a blip and think $60-$80 is a much more reasonable medium term price

While I agree with your analysis (its all based on fact so cant disagree really) i think its important to keep in mind that its not a bullmarket anymore AND even in a bullmarket, these valuation plays don't always work out.

As an example, Do you remember JRL and EME?

YOUNG_TRADER said:Anyhoo I'm in at 61c for a punt

Whats a punt exactly? 500k shares?

Good to see you back here.

Hey YT, I'll add my welcome to Nizars - and I'm extremely happy you chose AED to return with  If anyone is likely to get some interest back into this dog, you are.

If anyone is likely to get some interest back into this dog, you are.

In fact, let's just make this a little experiment in the power of one individual to influence a stock price. Looking at AEDs SP over the last year, one can really only see down down down (with some little blips up). Over the last two months we've seen a 40% decline with 25% of that in the last ten days!!

It shouldn't then be too difficult to see whether YTs entering the fray has a positive impact - anyone with me on this?

Sorry if this is offensive YT - I'll be happy to withdraw the post if it is

PS There was one line in the half yearly that did have me concerned

This obviously relates to the **** production of 2000bopd rather than 10-20k that they were originally planning for, but if they can't fix that with the cash they've got then, well, as YT pointed out, SINO may not have to pay much at all.

Oh well, I'll be watching the next few weeks to see if the YT factor comes into play

In fact, let's just make this a little experiment in the power of one individual to influence a stock price. Looking at AEDs SP over the last year, one can really only see down down down (with some little blips up). Over the last two months we've seen a 40% decline with 25% of that in the last ten days!!

It shouldn't then be too difficult to see whether YTs entering the fray has a positive impact - anyone with me on this?

Sorry if this is offensive YT - I'll be happy to withdraw the post if it is

PS There was one line in the half yearly that did have me concerned

The Company has recognised an impairment write-down of $50.6 million in relation to its production assets as a result of

recent production performance, the current economic conditions and the fall in oil commodity prices

This obviously relates to the **** production of 2000bopd rather than 10-20k that they were originally planning for, but if they can't fix that with the cash they've got then, well, as YT pointed out, SINO may not have to pay much at all.

Oh well, I'll be watching the next few weeks to see if the YT factor comes into play

- Joined

- 18 February 2006

- Posts

- 4,200

- Reactions

- 2

Hey Niz, yeah long time bud hope you've been well

To be honest I had no idea how much SIPC had paid for the 60% share and I didn't think the funds actually came through, so was very surprised to see they had

I think the oil price is definately hurting AED but the fact that it has plenty of cash to last at least 12months with current unprofitable conditions means that when/if the oil price goes back to say $60 then profitability will return as will the predators imo

I don't know why AED don't just store the oil and wait for higher prices, I think I read somewhere Exxon Mobil where doing that, I think its a gamble but smart

lol the YT factor I think AED is a bit more sophisticated than that

Any chartist views?

To be honest I had no idea how much SIPC had paid for the 60% share and I didn't think the funds actually came through, so was very surprised to see they had

I think the oil price is definately hurting AED but the fact that it has plenty of cash to last at least 12months with current unprofitable conditions means that when/if the oil price goes back to say $60 then profitability will return as will the predators imo

I don't know why AED don't just store the oil and wait for higher prices, I think I read somewhere Exxon Mobil where doing that, I think its a gamble but smart

lol the YT factor I think AED is a bit more sophisticated than that

Any chartist views?