- Joined

- 9 August 2015

- Posts

- 55

- Reactions

- 0

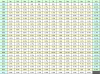

Your 12 weeks history yielded only 23 signals, or <2 per week. This week and next week you have 6 signals per week.

Any reason as to why?

I have been thinking the same and have no idea why, the same patterns are showing up more often and Im not sure what it means.

Next week will tell the story i guess skc.