Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,279

- Reactions

- 11,531

Or, maybe this is old news now?

What's hot in metal? Punters tip moly holy

Mark Hawthorne

April 18, 2007

THOSE who missed the boat on the nickel and uranium booms have been trying to identify the next hot commodity.

For months, hedge funds have been taking a bet on molybdenum stocks ”” a metal that resists heat, cold and corrosion better than steel ”” and it looks like they've hit pay dirt.

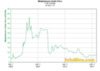

In Australian mining circles molybdenum is called "moly", and its price has been soaring since January, due to export restrictions in China.

China has the world's largest molybdenum reserves, but in 2005, peasants in Hubei blamed molybdenum mines for poisoning the Chaoshui river. Rioters destroyed an estimated 200 molybdenum mines, crippling the world's supplies.

Ironically, environmental issues are the reason for moly's soaring price ”” it is used by a range of power industries to remove sulphur from emissions, and in oil, gas and water pipelines to prevent rust.

The global molybdenum producers ”” Phelps Dodge, Codelco and Rio Tinto ”” increased output in 2005 after the China riots, but the price of moly on the spot market rose from an average $US4.50 a pound (in the 10 years to 2004) to a record $US40 in late 2005. The price slid back last year, but has again been creeping up, to $US29 a pound.

The interest in the metal has been enough for the London Metals Exchange to announce plans for a moly market, which will begin later this year.

One player is Perth-based Moly Mines, which is listed on the Australian Stock Exchange and in Toronto, where it raised $24 million through a placement this month. The company is developing the Spinifex Ridge molybdenum project.

Moly Mines, which once had Andrew "Twiggy" Forrest as its chairman, has soared since January. It share price is up 400 per cent, from a fraction over $1 a share to $4.99 yesterday. It was given a speeding ticket from the ASX in February

Moly Mines chief executive Derek Fisher has just returned from an investment roadshow in London, where his pitch was that the world's energy pipelines are rotting and need replacing ”” with pipes made frommolybdenum.

What's hot in metal? Punters tip moly holy

Mark Hawthorne

April 18, 2007

THOSE who missed the boat on the nickel and uranium booms have been trying to identify the next hot commodity.

For months, hedge funds have been taking a bet on molybdenum stocks ”” a metal that resists heat, cold and corrosion better than steel ”” and it looks like they've hit pay dirt.

In Australian mining circles molybdenum is called "moly", and its price has been soaring since January, due to export restrictions in China.

China has the world's largest molybdenum reserves, but in 2005, peasants in Hubei blamed molybdenum mines for poisoning the Chaoshui river. Rioters destroyed an estimated 200 molybdenum mines, crippling the world's supplies.

Ironically, environmental issues are the reason for moly's soaring price ”” it is used by a range of power industries to remove sulphur from emissions, and in oil, gas and water pipelines to prevent rust.

The global molybdenum producers ”” Phelps Dodge, Codelco and Rio Tinto ”” increased output in 2005 after the China riots, but the price of moly on the spot market rose from an average $US4.50 a pound (in the 10 years to 2004) to a record $US40 in late 2005. The price slid back last year, but has again been creeping up, to $US29 a pound.

The interest in the metal has been enough for the London Metals Exchange to announce plans for a moly market, which will begin later this year.

One player is Perth-based Moly Mines, which is listed on the Australian Stock Exchange and in Toronto, where it raised $24 million through a placement this month. The company is developing the Spinifex Ridge molybdenum project.

Moly Mines, which once had Andrew "Twiggy" Forrest as its chairman, has soared since January. It share price is up 400 per cent, from a fraction over $1 a share to $4.99 yesterday. It was given a speeding ticket from the ASX in February

Moly Mines chief executive Derek Fisher has just returned from an investment roadshow in London, where his pitch was that the world's energy pipelines are rotting and need replacing ”” with pipes made frommolybdenum.