- Joined

- 20 July 2021

- Posts

- 11,972

- Reactions

- 16,667

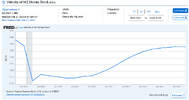

yes a big lump of flexibility in one's back pocket looks like a good planSure, but that is my point, I want a base to work off, I'm going with M2 dropping causing lower inflation(with a lag)

All the Ifs and Buts can go sort it out behind the back shed, the ones left standing will have an influence but it's too hard to see those outcomes from here.

Could well be wrong and happy to adjust on the way through.

i am just steering clear of the US ( ever since Biden was elected )

good luck