- Joined

- 20 July 2021

- Posts

- 11,794

- Reactions

- 16,439

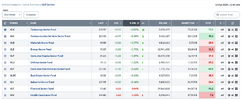

i already hold useful amounts of GNC and SGLLV on the theory increased US consumption of grain ( for bio-fuels ) will leave export opportunities elsewhere

but maybe i could revisit GNC and check it there is an accumulate opportunity

but maybe i could revisit GNC and check it there is an accumulate opportunity