tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,446

- Reactions

- 6,471

Personally I have found that over the years methods with positive expectancy will get me out of and back into a portfolio without catastrophic damage to my investments.

May I ask why you hold cdm they have been under performing their benchmark by 4.5% for the last 10 years?i noted that LIC CDM went to 100% cash in March 2020 , and started 'cherry-picking ' on the way into the recovery ( i hold CDM )

His modus operandi is to be hands off and not to get involved in the ordinary course of business but occasionally he will get involved/activist when things really go wrong. This is something retail investors cannot do and is a huge advantage he has.no he doesn’t, quite the opposite actually.

He actually admits there is some companies that he owns 100% of and hasn’t spoken to the management in years, besides a generic letter he writes once a year addressed to all his managers.

And the companies on the share market he owns he doesn’t really contact at all.

You mean like Salomon bros incident, yeah that’s a very rare incident, and one he would admit that he would not want to be involved in again.His modus operandi is to be hands off and not to get involved in the ordinary course of business but occasionally he will get involved/activist when things really go wrong. This is something retail investors cannot do and is a huge advantage he has.

Even for example in Net Jets Buffett forcefully replaced a few CEOs and at Berkshire Energy he pushed out Dave Sokol for ethical breaches. Yes I agree its quite rare. And yes those were wholly owned subsidiaries. But the fact that remains that in certain situations he can do that sort of thing when absolutely necessary and it is an important advantage over retail investors.You mean like Salomon bros incident, yeah that’s a very rare incident, and one he would admit that he would not want to be involved in again.

But yeah my point is that he isn’t on any boards, and even in his younger years was on only a handful, and both him and Charlie admitted that their time on boards was a waste of time.

Yeah of course, that’s his job.Even for example in Net Jets Buffett forcefully replaced a few CEOs and at Berkshire Energy he pushed out Dave Sokol for ethical breaches. Yes I agree its quite rare. And yes those were wholly owned subsidiaries. But the fact that remains that in certain situations he can do that sort of thing when absolutely necessary and it is an important advantage over retail investors.

I agree with what you are saying that doesn't seek to do it as an intentional strategy for his marketable securities purchases but he can do it in some cases if push comes to shove which I think we both agree on.But going back to div’s original claim that Buffett seeks to get into the board and control the companies he owns shares in, that is obviously not true.

but when we ( CDM and i ) both buy the same stock we do the polar opposites and still make money on itMay I ask why you hold cdm they have been under performing their benchmark by 4.5% for the last 10 years?

i understood that in recent years they selected a director ( or more ) to watch and push for changes that were neededYou mean like Salomon bros incident, yeah that’s a very rare incident, and one he would admit that he would not want to be involved in again.

But yeah my point is that he isn’t on any boards, and even in his younger years was on only a handful, and both him and Charlie admitted that their time on boards was a waste of time.

Not in any situation I am aware of.i understood that in recent years they selected a director ( or more ) to watch and push for changes that were needed

Warren used to buy when there was blood in the street , and would offer big cash injections buying shares, preference shares and warrants or a mix depending on the deal , now most times preference shares don't get voting rights until they are converted .Not in any situation I am aware of.

They are not activist investors, if they felt there needed to be big changes, I don’t think they would be buying in.

Yeah, you are talking about during the GFC he did a couple of big deals involving cash injections, basically operating as lender of last resort in some cases. We got about 10% interest plus warrants that gave him upside exposure to share price recovery.Warren used to buy when there was blood in the street , and would offer big cash injections buying shares, preference shares and warrants or a mix depending on the deal , now most times preference shares don't get voting rights until they are converted .

chances are several companies Warren had bought into were great companies at the time by run by idiots , ,,,, maybe 'activist ' in the old sense , but not the current trend for activist ( social agendas , climate agendas , etc etc. ) more the old 'this is how you get your books in order ' style

and given his ( Berkshire's ) level of cash i would expect him to be ready for those sort of moves againYeah, you are talking about during the GFC he did a couple of big deals involving cash injections, basically operating as lender of last resort in some cases. We got about 10% interest plus warrants that gave him upside exposure to share price recovery.

Trump's announcement when he comes into office has hit mainstream media with 10% tariffs on China and 25% on all goods from Mexico and Canada.It always happens when everyone least expects it, I'm speculating it's going to go bear or bull but not sideways when Trump takes over.

that will shake some confidence it basically abandons NAFTA , and might make other US trading partners rather nervous ( that they will be next )25% on all goods from Mexico and Canada.

Trump hasn't even waited until new manufacturing businesses are up and running.that will shake some confidence it basically abandons NAFTA , and might make other US trading partners rather nervous ( that they will be next )

but remember tariffs end up being a tax on consumers

well i am on edge , but then , i have always been the hungry minnow looking for an angle , i don't have a big belly , but i do like tastyTrump hasn't even waited until new manufacturing businesses are up and running.

Other countries will counteract I would imagine, like China banning rare earth exports.

I can't see US inflation falling really fast.

I bet China is laughing in one way, their populace was poor to start with and it's not hard going back to that type of life if you've lived it but on the other hand for the US populace it's a different story.

As for the stock markets it's got to be one of the most nervous times in history.

well he has a reputation of a deal-maker , and he has wrangled some big ones25% tariffs on Canadian imports, Trump's got to be kidding himself or he's going to use it as leverage to get exports cheaper.

It’s a silly move in my opinion, when we are escalating the war in Ukraine, and hoping China stays out of it, we are giving them less reason to want to keep us happy.Trump's announcement when he comes into office has hit mainstream media with 10% tariffs on China and 25% on all goods from Mexico and Canada.

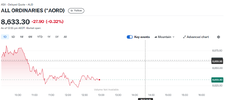

View attachment 188496

ASX in the red, Aussie dollar drops on Trump tariff threat — as it happened

Local stocks reversed and the Australian dollar fell near a seven-month low as the incoming US president pledged a 25 per cent tariff on all products from Mexico and Canada. Here's how the trading day unfolded on the ABC News live markets blog.www.abc.net.au

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.