CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

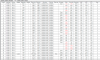

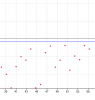

Well this was certainly worth another thread IMO...compared to the practice i did on the DAX, the HSI is so fast. Even with the DAX on x3 speed its nothing compared to this. There must be quite an adjustment period in order to master this. At the same time there is some great momentum moves if you get on the right side. I'm using a 10 tick stop.

1 Contract to start with and I'm only taking trades that seem very obvious to me...Even then with prices flitting around so much i don't feel completely confident that the trades i took were based on anything more than the chart at this stage.

CanOz

1 Contract to start with and I'm only taking trades that seem very obvious to me...Even then with prices flitting around so much i don't feel completely confident that the trades i took were based on anything more than the chart at this stage.

CanOz

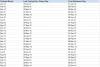

It so thin and illiquid you can't tell what its going to do next. I see no evidence of anything useful in the DOM at all.

It so thin and illiquid you can't tell what its going to do next. I see no evidence of anything useful in the DOM at all.