IFocus

You are arguing with a Galah

- Joined

- 8 September 2006

- Posts

- 7,471

- Reactions

- 4,465

At first thought, is this influenced by a large number of speccy miners that are included within that index?

I understand that the XAO does have miners too, but these are the big guns that will probably not create as much of a drag on their indicies.

Can I make an assumption?? If a major correction was to appear, would XSO Small Ords be likely to suffer less than XAO because "the bombs never hit you when you're down so low." This statement correct or very incorrect?? If money ever flows out of big caps and back into Term Deposits (I personally cannot see this happening in a very long time), will they converge again and the gap returns back to "normal".

While things are OK, it seems better to "take your money out of the bank and buy their shares".

At first thought, is this influenced by a large number of speccy miners that are included within that index?

At first thought, is this influenced by a large number of speccy miners that are included within that index?

I understand that the XAO does have miners too, but these are the big guns that will probably not create as much of a drag on their indicies.

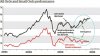

2280 to 2290 has posed as resistance for this third time but certainly that 2 1/2 year DT line has been broken. What else could happen from here?XSO has finally broken free of my pitch fork down trend line.

Waiting see if a higher low forms hopefully this period will form some nice consolidations for some low risk entries to hitch a ride higher.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.