Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

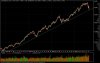

Re: XAO Analysis

Yes Hopefully Magdoran will be posting todays bar as an exhaustion bar?

Oh My Goodness .......

Yes Hopefully Magdoran will be posting todays bar as an exhaustion bar?