- Joined

- 9 September 2005

- Posts

- 209

- Reactions

- 0

Re: XAO Analysis

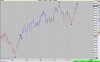

Interesting use of Elephants and Rabbits as analysis tools, anyway do people think it's a "V" reversal or are we waiting for the "W" to form, that is the $64 question.

My money is on the "W".... but some is on "V" already.

Interesting use of Elephants and Rabbits as analysis tools, anyway do people think it's a "V" reversal or are we waiting for the "W" to form, that is the $64 question.

My money is on the "W".... but some is on "V" already.