- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Yes that was quick enough for me to enter 3 sell orders struz.

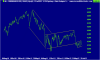

4132. Removing my sell orders now. Assuming it's game on. See how the close goes.

GB, you ever had a look at Market Profile?

Check it here: http://http://en.wikipedia.org/wiki/Market_profile

I think you find this very appropriate for the analysis you do.

Cheers,

CanOz

GB, you ever had a look at Market Profile?

Check it here: http://http://en.wikipedia.org/wiki/Market_profile

I think you find this very appropriate for the analysis you do.

Cheers,

CanOz

Doesn't Market Profile require mapping volume against traded prices? How would that work on GBs XAO chart?

Thanks Can, Could be handy. I like the idea of 'day types' and might add that in once I've understood it better.

Do you have a preference for the smaller banks over the big four? If so, can you say why?Banks looking great. NAB, BEN, BOQ etc.

SLX is a high tight flag, so I'm buying that.

I think we might have another big green candle tomorrow on the Ords, led by the financials.

Banks looking great. NAB, BEN, BOQ etc.

Do you have a preference for the smaller banks over the big four? If so, can you say why?

They still look ok but I'll just stick with SLX and see how that goes.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.