- Joined

- 5 May 2010

- Posts

- 269

- Reactions

- 1

Bought 425 @ 26.52 today, gambling with my new margin loan. My first ever stock purchase not thru employee SPP etc.

If this did occur, to me that seems to be a 3-5 year return (dividends + reinvestment + capital gain) of 9-13%. Given the solid nature of WOW what do others think about that sort of return?

Bought 425 @ 26.52 today, gambling with my new margin loan. My first ever stock purchase not thru employee SPP etc.

Don't you get employee discount, most place I work offer like 5%-10%

discount for staff purchase with limitation of course.

I expect wow to test the lows of $25.00 (and lower) before there is any kind of bounce linked to the AGM and dividend announcement.

That's all very fine, tyson. Yes, WOW is a successful business.

But it's SP is essentially flat. $34 just before the GFC and now a miserable $26.50 or so.

And the yield at 4.5% hardly makes up for the lack of capital appreciation.

So I don't see the point in 'owning a magnificent business' if you're not making decent money out of it.

Dropping to an interday low of $26.24, wow has crept back up to the $26.50 - $26.60 range and held it for the last few days. Due to announce it's div on Monday 21/02/11, it would not surprise me to see the price run up before it goes exdiv, like it did last year.

Seems to have a pattern of rebounds between reporting and going exdiv, then crashing after going exdiv (Dividend strippers perhaps?).

Another buying opportunity yesterday, shortly after open, when the share traded arround $26.30 before working it's way up to $26.95 to close on $26.85.

Response to the Report released seems fairly muted. The press release summary shows continued growth, reduction in costs, increased profits, increased earnings per share and increased dividends per share.

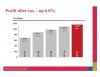

View attachment 41606

Page 20-21 of the press release shows the continued improvement in profit after tax over the past 5 years, yet some analysts consider this to be a soft result. You have to wonder what these people expect. WOW has maintained profitability during the gfc, maintained dividends and is now trading at a lower price earnings ratio than it was in 2007 (before the gfc), yet for some it is not good enough.

View attachment 41607

I suspect the market will get behind wow in the run up to going exdiv and I wouldn't be surprised to see it go higher after going exdiv. WOW appears to be focused on maintaining and improving market share in the foundation components of "Food, Fuel and Alcohol" and in reducing overheads. Sounds like good principles to running a business to me. As always DYOR.

50% off running through catalogs weekly isn't sustainable - and with a new model Coles is moving to (PM if you want further info) sales will start to suffer as a result.

Just my

Hi Nulla Nulla,

As somebody in the industry - I can tell you now that the muted response to WOW's report is justified - both on an indirect level (floods etc) and direct level (competition).

Things are really heating up in the market place. Coles have lagged WOW for so long that their new strategy is to just bust bust bust suppliers for the lowest prices and drag consumers into their doors - no matter what the cost. If you look in any major category in the supermarket (say washing powder) you will see some very heavy discounts across the board - and not just on 1 or 2 brands.

Retailers do receive benefits for running these specials (they usually calculate part of the difference between the special and give it back to WOW) but this constant price warring won't help sales and the bottom line. 50% off running through catalogs weekly isn't sustainable - and with a new model Coles is moving to (PM if you want further info) sales will start to suffer as a result.

Just my

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.