- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

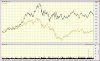

I can't help getting excited about WOW at the moment as growing profitability is shown in the recent results. Analysts are looking for a price of $30.50 but the shares may well be set to move on further than that. I have a sell plan at around $35 and expect the target to be reached in 2010, however, I was wrong last time.

The chart shows a sharp breakout from the downtrend that has surprised many as Coles looked to be doing better. I tell yee, "Coles, you are no President Woolworths."

The chart shows a sharp breakout from the downtrend that has surprised many as Coles looked to be doing better. I tell yee, "Coles, you are no President Woolworths."