You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Weekly Portfolio - ASX

- Thread starter Warr87

- Start date

-

- Tags

- trend weekly trading

- Joined

- 27 August 2017

- Posts

- 1,450

- Reactions

- 749

Are you using weekly system Warr87?

I also have AYS as a buy on my weekly but after being a large range bar will only buy if trades above high.

I also have AYS as a buy on my weekly but after being a large range bar will only buy if trades above high.

- Joined

- 8 June 2008

- Posts

- 13,229

- Reactions

- 19,521

if it is of any consolation exactly same positions and situation (in: ays, missed others) for one of my system on mondayI only got 1 out of 3 fills. Unfortunately the 2 gapped up. I tend to get great fills, but even with the 3% premium I add to my limit order they had gapped up too much. Oh well.

Order filled: AYS

Orders missed: TZN, Z1P

- Joined

- 27 August 2017

- Posts

- 1,450

- Reactions

- 749

Do you close buy signal after Monday like Skate?

- Joined

- 8 June 2008

- Posts

- 13,229

- Reactions

- 19,521

With indicator switching to bear, i made sure all buy orders were closed at the end of the dayDo you close buy signal after Monday like Skate?

- Joined

- 22 May 2020

- Posts

- 1,276

- Reactions

- 681

Greeting Guys.

I am Sharing my portfolio. Any suggestions please,

ALL ARISTOCRAT LEISURE

ALU ALTIUM LIMITED

ANZ ANZ BANKING GRP LTD

APX APPEN LIMITED

ASB AUSTAL LIMITED

BHP BHP GROUP LIMITED

BKW BRICKWORKS LIMITED

BLD BORAL LIMITED.

CCP CREDIT CORP GROUP

CGF CHALLENGER LIMITED

CMW CROMWELL PROP

COH COCHLEAR LIMITED

CWY CLEANAWAY WASTE LTD

DXS DEXUS

EML EML PAYMENTS LTD

FPH FISHER & PAYKEL H.

GTN GTN LIMITED

ICE ICETANA LIMITED

IEL IDP EDUCATION LTD

IGL IVEGROUP

IVV ISHARES S&P 500 ETF

JHG JANUS HENDERSON

KMD KATHMANDU HOLD LTD

LYL LYCOPODIUM LIMITED

MGX MOUNT GIBSON IRON

MNY MONEY3 CORPORATION

MQG MACQUARIE GROUP LTD

MVF MONASH IVF GROUP LTD

NDQ BETASHARESNASDAQ100

NHC NEW HOPE CORPORATION

NWH NRW HOLDINGS LIMITED

OML OOH!MEDIA LIMITED

OOO BETASHARESCRUDEOIL

OSH OIL SEARCH LTD

PNV POLYNOVO LIMITED

QAN QANTAS AIRWAYS

SCG SCENTRE GRP

SSG SHAVER SHOP GRP LTD

STO SANTOS LTD

SWF SELFWEALTH

SXL STHN CROSS MEDIA

TNK THINK CHILDCARE

VAS VNGD AUS SHARES

VCX VICINITY CENTRES

VDHG VNGD DIV HIGH GROWTH

VTG VITA GROUP LTD

WEB WEBJET LIMITED

WOW WOOLWORTHS GROUP LTD

XRF XRF SCIENTIFIC

Best Regards..

Nice diversified portfolio, however I am too young for it.

The markets are looking very shaky at the moment. My asset allocation right now is:

precious metals ~15%

cash ~31%

equities ~54%

The equities that I am holding right now are just a few small cap miners, NCM and BUB.

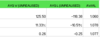

Week 20:

No buy/sell signals. Like everyone else's system, mine went down this week. As I was looking through a number of charts earlier in the week, a pull-back seems to be happening in a lot of places.

I did not lose as much as the market this week which is always nice. My -0.76% compared to XAO losing -3.07% and XAOA losing -3.01% compared to last week.

OpenPL: -1.2%

System: -23.2%

OpenPOS: 17

7 out of those 17 are in positive territory.

And some more metrics, because why not:

Those numbers will improve, I swear haha.

No buy/sell signals. Like everyone else's system, mine went down this week. As I was looking through a number of charts earlier in the week, a pull-back seems to be happening in a lot of places.

I did not lose as much as the market this week which is always nice. My -0.76% compared to XAO losing -3.07% and XAOA losing -3.01% compared to last week.

OpenPL: -1.2%

System: -23.2%

OpenPOS: 17

7 out of those 17 are in positive territory.

And some more metrics, because why not:

Those numbers will improve, I swear haha.

Well nothing to add since I had no buys/sells this week. However, it has so far been a bit of a crazy week. One day all of my positions were in the red and I was down a lot, the next day it had almost entirely recovered and everything was green. Today wasn't bad either. It's a weekly system so obviously the daily ups and downs don't matter but its still crazy to watch. Certainly a feeling of not knowing what is going to happen next!

over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,311

- Reactions

- 7,567

I buy based on sectors/industries, hold for a bit, then trim positions that aren't performing. E.g webjet vs flight centre. One's done considerably worse than the other/gets slammed much harder in the dips. Same with origin vs santos and the big three miners.

There's some stormy seas ahead yet however.

There's some stormy seas ahead yet however.

i buy on price momentum. The sectors that are doing well naturally feature into my portfolio as they are the best performing. It's a trend following strategy too so I give it enough time to breath and make a move, and if nothing happens then I cut it lose and move on.

This has certainly been a crazy market for me to go live with my account. At least it will make future trading seem like a walk in the park haha.

This has certainly been a crazy market for me to go live with my account. At least it will make future trading seem like a walk in the park haha.

- Joined

- 22 May 2020

- Posts

- 1,276

- Reactions

- 681

I buy based on sectors/industries, hold for a bit, then trim positions that aren't performing. E.g webjet vs flight centre. One's done considerably worse than the other/gets slammed much harder in the dips. Same with origin vs santos and the big three miners.

There's some stormy seas ahead yet however.

Commercial flights numbers are still quite low, also many nations are going back into lockdown

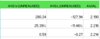

Week 21:

Buys: 5 buys but only room for 3. will update during the week as per usual

Sells: none

As mentioned in earlier post, it was a wild week. But as of Friday, when it counts for me, I was up. Current OpenPL: 2.7%. Total system performance at -20.43%. 17 Open positions but will be at a full 20 next week if I get my fills.

Only 7 out of the 17 positions are in positive territory right now, and most are only just after brokerage. Most have only been held for 5 or 6 weeks so we will see if they get hit by my stale exit. The biggest winner right now is my position in AEF. It is now +68% which is always nice. This is trend following so it only takes a couple of big winners out of the 35% win rate to make me profitable for the year. Maybe AEF is the 1? who knows.

Buys: 5 buys but only room for 3. will update during the week as per usual

Sells: none

As mentioned in earlier post, it was a wild week. But as of Friday, when it counts for me, I was up. Current OpenPL: 2.7%. Total system performance at -20.43%. 17 Open positions but will be at a full 20 next week if I get my fills.

Only 7 out of the 17 positions are in positive territory right now, and most are only just after brokerage. Most have only been held for 5 or 6 weeks so we will see if they get hit by my stale exit. The biggest winner right now is my position in AEF. It is now +68% which is always nice. This is trend following so it only takes a couple of big winners out of the 35% win rate to make me profitable for the year. Maybe AEF is the 1? who knows.

- Joined

- 27 August 2017

- Posts

- 1,450

- Reactions

- 749

Is your 35% win rate the back tested win rate of your system?

Yes it is. It actually has a much higher win rate depending on when you backtest. It gets upwards of 65%, even in sideways markets. 35% is the lower number. At the moment my realised winrate is 0% given that i entered all 20 positions not long before the COVID crash and all those positions suffered a loss.

Backtest is not fullproof and it is only a guide. I think 35% is realistic.

Backtest is not fullproof and it is only a guide. I think 35% is realistic.

I got my fills rather easily this morning. I now hold CDV, SPT, and RBL. full invested with 20 positions.

Additionally, I am moving closer to having an automated setup. I had a few spare computer parts around the house and decided to put together a server. I had been looking at a VPS on and off for a while, and I know qldfrog has an AWS that he recently setup, but I decided to do a homegrown solution. There are some disadvantages to this but hopefully it wont impact.

So far it has been going relatively smoothly. The server will end up being a dev area being a place for my data and in the future a python setup.

Additionally, I am moving closer to having an automated setup. I had a few spare computer parts around the house and decided to put together a server. I had been looking at a VPS on and off for a while, and I know qldfrog has an AWS that he recently setup, but I decided to do a homegrown solution. There are some disadvantages to this but hopefully it wont impact.

So far it has been going relatively smoothly. The server will end up being a dev area being a place for my data and in the future a python setup.

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

The sectors that are doing well naturally feature into my portfolio as they are the best performing.

One of the things I've been kicking around in my head for my weekly system is to first do a sector rotation to rank the sectors (not sure what period I'd apply to the rotation, weekly, monthly etc) and then focus the system on set ups across the top X sectors. I'd then apply the relevant sector index as the filter rather than the commonly used and more broader XAO. Must try and find some time to run those simulations to see how it performs.

One of the things I've been kicking around in my head for my weekly system is to first do a sector rotation to rank the sectors (not sure what period I'd apply to the rotation, weekly, monthly etc) and then focus the system on set ups across the top X sectors. I'd then apply the relevant sector index as the filter rather than the commonly used and more broader XAO. Must try and find some time to run those simulations to see how it performs.

You could either do an on/off filter for sector rotation. You could also change position sizes (via 'weights') for each sector based on its index. Would be interesting to see how it performs when you get to code it.

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

You could either do an on/off filter for sector rotation. You could also change position sizes (via 'weights') for each sector based on its index. Would be interesting to see how it performs when you get to code it.

My initial thoughts would be to base position size on something like rate of change (ROC) of the individual stock instead of based on sector index--interesting to see how ROC compares to a conventional approach such as ATR. Either way, would make for an interesting analysis via simulations I reckon