You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Weekly Portfolio - ASX

- Thread starter Warr87

- Start date

-

- Tags

- trend weekly trading

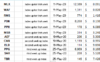

Week 18:

Buy: 4 new signals

Sell: None

I only have 4 new signals. The majority of the buy signals were for positions that I already hold! I gained +2.73% to my portfolio this week which is great. I know others have been able to taken advantage of even greater returns, but I am still happy with this. I don't know what happened Friday either as my system gained a significant amount on Friday alone (leaving me to close pretty strong in the week).

My system is now at an overall -19.23% with the XAO at -21.27%. I don't seem to be able to capture all of the gains from the XAO/XAOA but moving in the right direction! When I'm fully invested I'm sure I will start to see even greater returns. Given how this year has gone, realistically I would be happy to be at 0% by the end of the year.

Open profits: $982

Weekly Gain: +2.73%

#POS: 12

Buy: 4 new signals

Sell: None

I only have 4 new signals. The majority of the buy signals were for positions that I already hold! I gained +2.73% to my portfolio this week which is great. I know others have been able to taken advantage of even greater returns, but I am still happy with this. I don't know what happened Friday either as my system gained a significant amount on Friday alone (leaving me to close pretty strong in the week).

My system is now at an overall -19.23% with the XAO at -21.27%. I don't seem to be able to capture all of the gains from the XAO/XAOA but moving in the right direction! When I'm fully invested I'm sure I will start to see even greater returns. Given how this year has gone, realistically I would be happy to be at 0% by the end of the year.

Open profits: $982

Weekly Gain: +2.73%

#POS: 12

- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,887

The majority of the buy signals were for positions that I already hold!

Hey mate, I noticed that previously you confused yourself with receiving buy signals on stocks that you already own, and you mentioned above again as receiving more signals on stocks already bought.

So I am a little confused here as I would have thought that once you get a buy signal then it will require a sell to reset it, as per example below.

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

Sell = ExRem(Sell,Buy);

So out of curiosity how are you generating these signal.

Keep up the good work !!

Cheers

Trav

The majority of the buy signals were for positions that I already hold!

I'm with Trav. A little confused.

Without knowing your system a simple check could be a simple addition to your Filter.

This assumes you keep your already purchased stocks in a Watchlist. ie Holding.

Filter = Filter AND !InWatchListName( "Holding" ); // Note the ! Not

Cheers.

- Joined

- 8 June 2008

- Posts

- 13,229

- Reactions

- 19,520

@Nina4 , respectfully I think the "right" way should be @travI'm with Trav. A little confused.

Without knowing your system a simple check could be a simple addition to your Filter.

This assumes you keep your already purchased stocks in a Watchlist. ie Holding.

Filter = Filter AND !InWatchListName( "Holding" ); // Note the ! Not

Cheers.

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

otherwise you risk transferring the issue into the reliability of you "holding" watch list

my 2c..I am no expert the only reason I see not doing Trav's way would be to enable entry at all stage, not only the first instance

@Nina4 , respectfully I think the "right" way should be @trav

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

otherwise you risk transferring the issue into the reliability of you "holding" watch list

my 2c..I am no expert the only reason I see not doing Trav's way would be to enable entry at all stage, not only the first instance

The "Right" way is a loop.

We don't get to see Warr87's code.

Hence the "simple check"

otherwise you risk transferring the issue into the reliability of you "holding" watch list

I'm not sure what you mean. Maintaining a Watchlist is such a trivial thing.

Again "a simple check". A bandaid.

Cheers.

- Joined

- 4 December 2008

- Posts

- 486

- Reactions

- 281

One reason to do it as @Nina4 suggested is if running multiple systems. Assuming you don't want systems suggesting stocks you already hold in another system.

He just means that if you can prevent the issue in code then it takes out the human error element. Trivial task or not, the risk of human error still exists.

I'm not sure what you mean. Maintaining a Watchlist is such a trivial thing.

He just means that if you can prevent the issue in code then it takes out the human error element. Trivial task or not, the risk of human error still exists.

What do you mean? I explore for the previous 1 bar, so how would AB know what positions are held within my brokers account? I also never got the looping to work for the stale exit, so even if I did the Exploration back to when I started the system, it wouldn't do me any good anyway. I managed to implement the stale exit with the n-bar exit stop added in, but it wasn't quiet right or as good as the loop (when the loop is done right). Therefore I just have to manually do everything as I have no idea how to fix it with code and I was spending a huge amount of time getting nowhere (and incredibly frustrated as well).

Yes, human error does exist but as stated, I can't fix it with coding.

And thanks for the comments. The watchlist idea would be good for multiple systems as @Lone Wolf suggested.

Yes, human error does exist but as stated, I can't fix it with coding.

And thanks for the comments. The watchlist idea would be good for multiple systems as @Lone Wolf suggested.

- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,887

@Warr87 I feel your pain mate, it can be very frustrating and many hours spent researching only to get nowhere, but I suppose that is why we come to the forum to learn from others and move forward in out journey.

I am no expert but enjoy learning and sharing what I have discovered so hopefully the below can be of use to you, if not just ignore it.

******

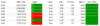

Just to clarify my comment above about ExRem I have included a couple of examples that will prevent multiple signals being displayed either in exploration or on the chart.

1- Without the ExRem function

- 4 signals generated over the last few months

- 3 consecutive signals having the potential for you to enter each time

2 With ExRem function

- 2 signals generated over the same time period above

- NO consecutive buy signals shown as the ExRem function inhibits them being displayed

So hopefully that clarifies my comments on the ExRem and if not, please let me know.

Cheers

I am no expert but enjoy learning and sharing what I have discovered so hopefully the below can be of use to you, if not just ignore it.

******

Just to clarify my comment above about ExRem I have included a couple of examples that will prevent multiple signals being displayed either in exploration or on the chart.

1- Without the ExRem function

- 4 signals generated over the last few months

- 3 consecutive signals having the potential for you to enter each time

2 With ExRem function

- 2 signals generated over the same time period above

- NO consecutive buy signals shown as the ExRem function inhibits them being displayed

So hopefully that clarifies my comments on the ExRem and if not, please let me know.

Cheers

Attachments

Thanks mate. Appreciate it. That makes things clearer.

I'm also getting very frustrated over my python project as there is little documentation for things. Even Norgate's python API is no help as there is no real explanation on how to use my subscription with Zipline, lol.

I'm also getting very frustrated over my python project as there is little documentation for things. Even Norgate's python API is no help as there is no real explanation on how to use my subscription with Zipline, lol.

- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,887

I'm also getting very frustrated over my python project as there is little documentation for things. Even Norgate's python API is no help as there is no real explanation on how to use my subscription with Zipline, lol.

Well I had to google the above as I had no idea what you were talking about

Good luck with it.

Zipline is good but the presumption is for the US market. You have to do custom bundle integration for AUS stocks. I also sent an email to Norgate and they weren't too much help tbh. I need to, at some point, send them a more detailed email about it but it boils down to: I don't understand how to integrate the Norgate data into zipline and little to no information is there on how to do it (but a few snipets of code that are mostly replicas of the Zipline documentation).

Writing systems in python isn't too bad mate! I have found many examples and while it is a little more complicated than AFL, there are some python engines that probably make it even easier than AFL. Your coding abilities are better than mine so I'm sure you would be fine with python. The biggest hurdle is integration of data to use for backtesting.

There are also many models written in python for analysis of systems, such as pyfolio. Libraries for analysing alpha too. I may get there one day but I'm real tempted to hire a programmer. I was only going to do this for the IB API side of things but given I can't seem to get Norgate/Zipline to work I'm at my wits end.

(End rant haha)

Writing systems in python isn't too bad mate! I have found many examples and while it is a little more complicated than AFL, there are some python engines that probably make it even easier than AFL. Your coding abilities are better than mine so I'm sure you would be fine with python. The biggest hurdle is integration of data to use for backtesting.

There are also many models written in python for analysis of systems, such as pyfolio. Libraries for analysing alpha too. I may get there one day but I'm real tempted to hire a programmer. I was only going to do this for the IB API side of things but given I can't seem to get Norgate/Zipline to work I'm at my wits end.

(End rant haha)

Greeting Guys.

I am Sharing my portfolio. Any suggestions please,

ALL ARISTOCRAT LEISURE

ALU ALTIUM LIMITED

ANZ ANZ BANKING GRP LTD

APX APPEN LIMITED

ASB AUSTAL LIMITED

BHP BHP GROUP LIMITED

BKW BRICKWORKS LIMITED

BLD BORAL LIMITED.

CCP CREDIT CORP GROUP

CGF CHALLENGER LIMITED

CMW CROMWELL PROP

COH COCHLEAR LIMITED

CWY CLEANAWAY WASTE LTD

DXS DEXUS

EML EML PAYMENTS LTD

FPH FISHER & PAYKEL H.

GTN GTN LIMITED

ICE ICETANA LIMITED

IEL IDP EDUCATION LTD

IGL IVEGROUP

IVV ISHARES S&P 500 ETF

JHG JANUS HENDERSON

KMD KATHMANDU HOLD LTD

LYL LYCOPODIUM LIMITED

MGX MOUNT GIBSON IRON

MNY MONEY3 CORPORATION

MQG MACQUARIE GROUP LTD

MVF MONASH IVF GROUP LTD

NDQ BETASHARESNASDAQ100

NHC NEW HOPE CORPORATION

NWH NRW HOLDINGS LIMITED

OML OOH!MEDIA LIMITED

OOO BETASHARESCRUDEOIL

OSH OIL SEARCH LTD

PNV POLYNOVO LIMITED

QAN QANTAS AIRWAYS

SCG SCENTRE GRP

SSG SHAVER SHOP GRP LTD

STO SANTOS LTD

SWF SELFWEALTH

SXL STHN CROSS MEDIA

TNK THINK CHILDCARE

VAS VNGD AUS SHARES

VCX VICINITY CENTRES

VDHG VNGD DIV HIGH GROWTH

VTG VITA GROUP LTD

WEB WEBJET LIMITED

WOW WOOLWORTHS GROUP LTD

XRF XRF SCIENTIFIC

Best Regards..

I am Sharing my portfolio. Any suggestions please,

ALL ARISTOCRAT LEISURE

ALU ALTIUM LIMITED

ANZ ANZ BANKING GRP LTD

APX APPEN LIMITED

ASB AUSTAL LIMITED

BHP BHP GROUP LIMITED

BKW BRICKWORKS LIMITED

BLD BORAL LIMITED.

CCP CREDIT CORP GROUP

CGF CHALLENGER LIMITED

CMW CROMWELL PROP

COH COCHLEAR LIMITED

CWY CLEANAWAY WASTE LTD

DXS DEXUS

EML EML PAYMENTS LTD

FPH FISHER & PAYKEL H.

GTN GTN LIMITED

ICE ICETANA LIMITED

IEL IDP EDUCATION LTD

IGL IVEGROUP

IVV ISHARES S&P 500 ETF

JHG JANUS HENDERSON

KMD KATHMANDU HOLD LTD

LYL LYCOPODIUM LIMITED

MGX MOUNT GIBSON IRON

MNY MONEY3 CORPORATION

MQG MACQUARIE GROUP LTD

MVF MONASH IVF GROUP LTD

NDQ BETASHARESNASDAQ100

NHC NEW HOPE CORPORATION

NWH NRW HOLDINGS LIMITED

OML OOH!MEDIA LIMITED

OOO BETASHARESCRUDEOIL

OSH OIL SEARCH LTD

PNV POLYNOVO LIMITED

QAN QANTAS AIRWAYS

SCG SCENTRE GRP

SSG SHAVER SHOP GRP LTD

STO SANTOS LTD

SWF SELFWEALTH

SXL STHN CROSS MEDIA

TNK THINK CHILDCARE

VAS VNGD AUS SHARES

VCX VICINITY CENTRES

VDHG VNGD DIV HIGH GROWTH

VTG VITA GROUP LTD

WEB WEBJET LIMITED

WOW WOOLWORTHS GROUP LTD

XRF XRF SCIENTIFIC

Best Regards..

- Joined

- 8 June 2008

- Posts

- 13,229

- Reactions

- 19,520

what would python provide you over AFL?

Python is good for AI, image/shape processing and could have potential applications to add machine learning to systematic trading, no issue there but for the basic trends following, breakout detection etc, AB from a programmer point of view is really good and easy to use.

Unless you plan to do Machine learning or want to avoid paying a AB license, I do not really see the point to be honest, at least at this stage

Python is good for AI, image/shape processing and could have potential applications to add machine learning to systematic trading, no issue there but for the basic trends following, breakout detection etc, AB from a programmer point of view is really good and easy to use.

Unless you plan to do Machine learning or want to avoid paying a AB license, I do not really see the point to be honest, at least at this stage

For me it is the automation that I intend on including. And if you run multiple systems and instruments, then its beneficial. If you only intend on doing one market and one instrument, probably not worth it. I also think the data analytics that can be run are more extensive in python, particularly since a lot of the python libraries for that are shared and opensource.

And I'm open to the idea of ML as well. Or at least I find it fascinating. There are a few good youtube clips and plenty of tutorials on doing basic ML with finance, which python is very good to use.

And I'm open to the idea of ML as well. Or at least I find it fascinating. There are a few good youtube clips and plenty of tutorials on doing basic ML with finance, which python is very good to use.

Also, with the talk of python and Machine Learning (ML), I thought I'd provide a few links:

https://www.youtube.com/user/sentdex

http://sentdex.com/financial-analysis/asx/

https://pythonprogramming.net/

I have a few other youtube channels that I follow, but thought I'd share this one first. I find his tutorials pretty interesting and useful. I have also included his 2 websites. The sentdex website is based on some ML he does with natural language processing for sentiment. I know in some of his tutorials with quantopian he also uses that as a metric for finding alpha.

https://www.youtube.com/user/sentdex

http://sentdex.com/financial-analysis/asx/

https://pythonprogramming.net/

I have a few other youtube channels that I follow, but thought I'd share this one first. I find his tutorials pretty interesting and useful. I have also included his 2 websites. The sentdex website is based on some ML he does with natural language processing for sentiment. I know in some of his tutorials with quantopian he also uses that as a metric for finding alpha.

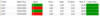

Week 19

Buy: 3

Sell: None

Total openPL 0.7% (down from last week). As mentioned in another thread, I saw profits go up by wednesday and then evaporate thursday. From what I've seen some others have also lost some open profits this week. Rather strange given that the market itself did pretty well. A brief look at the charts for a number of my positions looks like a consolidation. I can only hope.

Bit of context, I guess: I'm almost up 1% after a month of resuming trading. 1% every month wouldn't be so bad (but obviously more would be needed to recover losses in March).

I trade on.

Buy: 3

Sell: None

Total openPL 0.7% (down from last week). As mentioned in another thread, I saw profits go up by wednesday and then evaporate thursday. From what I've seen some others have also lost some open profits this week. Rather strange given that the market itself did pretty well. A brief look at the charts for a number of my positions looks like a consolidation. I can only hope.

Bit of context, I guess: I'm almost up 1% after a month of resuming trading. 1% every month wouldn't be so bad (but obviously more would be needed to recover losses in March).

I trade on.