This is a mobile optimized page that loads fast, if you want to load the real page, click this text.

Yes - If you sacrifice 7.2% of the avegage wage figure. (Each time it increases you need to increase you sacrifce amount so it stays at = 7.2%.)

A purchasing power equivalent of 60K in todays terms - the actual amount you will be retiring on is likely be substantially higher.

You shouldn't have to draw down the capital asset - so you could leave the perpetual income to your kids. (if the government doesn't introduce death taxes)

It all hinges in staying 100% exposed to equities at all times - If you can hack that psychologically.

I absolutly have. Every bone in my invstment body is about maintaing purchasing power.

Over time I can explain the model. Some finacial savy will be required to understand it.

The model is using a REAL interest rate [a rate achieved after covering tax, investment expenses and wage increases(my inflation proxy)]

Contributions need to stay a fixed 7.2% of the ever changing average wage.

A good question. Personally, for a 40 year accumulation then perpetual income stream plan, I wouldn't dream of any other allocation - but I have a wealth of historical data and understanding of first principle economic components that drive future real returns that alleviate many concerns that others may hold.

It's the fear that stops people achiving solid results and causes them to hold far inferior long term assets and adopt far inferior strategies.

Your type of questions are the sort of questions that need to be discussed in depth to stress test the assumptions and get comfortable with the plan. But I'm not going to answer it with justice today. I'll come back to it and maybe in the meantime you might get some others people's thoughts as well.

The plan I have outlined using salary sacrificing of 7.2% means an in hand reduction of only $3,754.04 per year on current figures.

You've identified a potential $14,000 - looking forward to seeing you plan with that amount of contribution available the result could be monumental!

Making a good point brty.

I could stage the wage over life, less early on and more later on to average out the same and the model would produce a different runway of yearly targets.

I mentioned that if you never achieved average wages then making 75% of average would require a higher % of your wage - but the 7.2% of what ever you do earn would give you approximately the equivalent of what you are used too.

Could muck around with a different wage progression rate in due course - but in the mean time I would be interested to know real life experiences compared to this flight path for the constantly at average wage over life assumption.

Are you any where near targets?

Do you generally have a higher saving capacity because of less comitment when young despite the lower wages?

The plan assumes no savings at all at age 23 - how valid is this? do people generally have some savings by then?

These two points are potentially big mitigating factors if you are not achieving average wages early in your career.

The long run (100+ year) nominal return (not including franking) for the ASX is 10.6%.

The approx. split is 6% capital growth and 4.6% dividend (not including franking) return.

The 5.25% yield is a nominal yield. It is what the capital actually yields in today’s terms.

My rational for choosing 5.25% was to look at historical and future economic drivers and ease it back a tad to be conservative.

It is made up of a 4% dividend return and a 1.25% imputation credit (assuming 75% franking)

This is lower than historical (if franking is included), lower than the approx. 5.5% grossed up currently available and we are currently slightly below where regressed dividend yield to economic drivers would place it on average.

I’ll try explaining the Real yield using the historical numbers.

The long-term rate as explained above is 4.6% dividend + 6% capital. = total 10.6% (before franking)

We are now in a franking regime world and market wide dividends are on average franked about 75% which would add about 1.5% in franking credit value not captured in the calculation of the 10.6% So a total gross nominal return of approx. 12.1%

We want to adjust this 12.1% downward to take account of:

Tax: our dividends 4.6%+1.5% franking credit are taxed at 15% in the super account this eliminates (4.6%+1.5%) x 15% = 0.9% of our nominal return.

Expenses: expenses come out of our nominal returns – subtract 0.5% of our nominal return for expenses.

Maintaining purchasing power: we have to maintain or purchasing power out of our nominal return. The long-term inflation rate has been 3.8% and productivity improvements about 1.6%. Given wages over the long term compensate for inflation and share productivity gains with capital. I estimate long term wage growth has been about (50% x 1.6%) + 3.8% = 4.6%. (luckily we are going to buy and hold, so we don't have to wory about funding tax obligations on this growth)

So real return historically = 12.1% - 0.9%(tax) -0.5%(expenses) -4.6%(wage growth) = ~ 6%.

I have chosen 4.25% to be conservative and because some of the economic drivers going forward like population growth and productivity might be weaker than history. Being invested 100% in equities for the long hall, Inflation if it spikes back up isn’t really that big problem for us because ‘long run’ (although with a nasty lag) inflation will roughly increase the nominal return by a similar rate that we have to deduct to maintain purchasing power. On the other hand, increasing inflation from this low point will destroy cash and bonds over the long term - forget the housing bubble, its only one symptom of the bond bubble.

So there you go – rate assumptions should be clear as mud now.

Obviously in retirement you would in all likely hood have 80% in investment grade bonds but having more of the investment grade annuities could help with the extra cash flow when changing your percentages in the portfolio..

Wealth Plan

- Thread starter craft

- Start date

-

- Tags

- plan wealth wealth plan

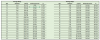

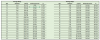

I was thinking about working through each of the variable estimates required in detail prior to putting up any model outcome, however somehow, I think I may have lost the interest of a lot who have already concluded the task was going to be too far out of reach if I went that avenue. So, I have made preliminary estimates for the variable required. I think they are realistic and defensible estimates and this is the flight plan outcome of modelling those estimates.

The average wage multiple is fixed – the Capital and Dividend Stream targets will ratchet up as average wage increases. This table is based on current average weekly earnings @ $1533.10

For the average wage earner, the modelled plan requires a salary sacrificed 7.2% of gross wage contribution every year to meet the target. (plus your standard 9.5% Employer superannuation guarantee amount)

For each age in the above table, there is a capital and dividend stream amount. Because Price/Dividend ratios fluctuate over time, In assessing your current situation against the plan you would need to have both stock(capital) and flow(dividend) above their respective target amounts before you could think about reducing the 7.2% contribution rate and still achieve the targeted outcome. If you are below these amounts you will need higher than 7.2% contributions going forward to catch up.

The 75% target would be tax free and in disposable income terms (currently $59,955) would be slightly more than the disposable pre-retirement income of $57,059.80.

Gross Salary $79,940.21

Less Salary Sacrifice $(5,731.36)

Taxable $74,208.85

Less Tax $(15,664.88)

Less Medicare $(1,484.18)

Disposable $57,059.80

If you are on less than average wage then achiving 75% of average wage requires a lot higher % of your income. Howere that same consistent ~7.2% sacrifice of your actual gross wage will stiil produce around the equivalent disposable retirement income as your pre-retirement disposabe wage.

The variable assumptions made:

Real rate of return: 4.25%

Nominal yield: 5.25% (including franking)

Asset class:

100% Equities.

Tax structure:

Superannuation.

Investment vehicle:

Broad, Low Coast, Non-synthetic Exchange Traded Equity Fund.

Key Consideration:

Volatility risk: Dividend flow has some volatility around the 5.25% average return assumed. Can the income needs be flexed (vary living expenses or have other back-up reserves) during below average yields to ensure capital does not need to be drawn down? If not 100% equity allocation close to and during retirement is not appropriate due to sequence risk and this plan is not appropriate.

If people are interested in this sort of wealth plan we can work through validating the assumptions and strategy choices, the model workings etc to ensure the plan is realistic which will fortify people’s belief systems to stay the course in times of market duress. Because at the end of the day none of this is too hard with a few right choices and some consistent application – Its more an issue of understanding than anything else.

The average wage multiple is fixed – the Capital and Dividend Stream targets will ratchet up as average wage increases. This table is based on current average weekly earnings @ $1533.10

For the average wage earner, the modelled plan requires a salary sacrificed 7.2% of gross wage contribution every year to meet the target. (plus your standard 9.5% Employer superannuation guarantee amount)

For each age in the above table, there is a capital and dividend stream amount. Because Price/Dividend ratios fluctuate over time, In assessing your current situation against the plan you would need to have both stock(capital) and flow(dividend) above their respective target amounts before you could think about reducing the 7.2% contribution rate and still achieve the targeted outcome. If you are below these amounts you will need higher than 7.2% contributions going forward to catch up.

The 75% target would be tax free and in disposable income terms (currently $59,955) would be slightly more than the disposable pre-retirement income of $57,059.80.

Gross Salary $79,940.21

Less Salary Sacrifice $(5,731.36)

Taxable $74,208.85

Less Tax $(15,664.88)

Less Medicare $(1,484.18)

Disposable $57,059.80

If you are on less than average wage then achiving 75% of average wage requires a lot higher % of your income. Howere that same consistent ~7.2% sacrifice of your actual gross wage will stiil produce around the equivalent disposable retirement income as your pre-retirement disposabe wage.

The variable assumptions made:

Real rate of return: 4.25%

Nominal yield: 5.25% (including franking)

Asset class:

100% Equities.

Tax structure:

Superannuation.

Investment vehicle:

Broad, Low Coast, Non-synthetic Exchange Traded Equity Fund.

Key Consideration:

Volatility risk: Dividend flow has some volatility around the 5.25% average return assumed. Can the income needs be flexed (vary living expenses or have other back-up reserves) during below average yields to ensure capital does not need to be drawn down? If not 100% equity allocation close to and during retirement is not appropriate due to sequence risk and this plan is not appropriate.

If people are interested in this sort of wealth plan we can work through validating the assumptions and strategy choices, the model workings etc to ensure the plan is realistic which will fortify people’s belief systems to stay the course in times of market duress. Because at the end of the day none of this is too hard with a few right choices and some consistent application – Its more an issue of understanding than anything else.

Last edited:

- Joined

- 3 April 2013

- Posts

- 1,061

- Reactions

- 273

So just to clarify for my simple brain.

With the assumptions you have made above at, 33 if I have $137k in super and sal sac 7.2% I will achieve a dividend stream of $60k after tax at the age of 63?

With the assumptions you have made above at, 33 if I have $137k in super and sal sac 7.2% I will achieve a dividend stream of $60k after tax at the age of 63?

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,521

i don't see that you've allowed for an increase in wage and contribution through out the 40 yrs ? Obviously the buying power at the end of the 40 yr period will not be as it is now. I think I saw somewhere that on average it will be about 1/3 over a 40 yr period so in 40 yrs like 330 k now

Getting there but not enough in my view.

Getting there but not enough in my view.

So just to clarify for my simple brain.

With the assumptions you have made above at, 33 if I have $137k in super and sal sac 7.2% I will achieve a dividend stream of $60k after tax at the age of 63?

Yes - If you sacrifice 7.2% of the avegage wage figure. (Each time it increases you need to increase you sacrifce amount so it stays at = 7.2%.)

A purchasing power equivalent of 60K in todays terms - the actual amount you will be retiring on is likely be substantially higher.

You shouldn't have to draw down the capital asset - so you could leave the perpetual income to your kids. (if the government doesn't introduce death taxes)

It all hinges in staying 100% exposed to equities at all times - If you can hack that psychologically.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,521

Craft.

How do you feel about the all eggs in one basket argument.

A severe event could leave a period of much lower growth than

Indicated. That period could impact massively on those at retirement

And those with a plan like yours.

Imagine a 10 yr period of no growth or even negative!

How do you feel about the all eggs in one basket argument.

A severe event could leave a period of much lower growth than

Indicated. That period could impact massively on those at retirement

And those with a plan like yours.

Imagine a 10 yr period of no growth or even negative!

i don't see that you've allowed for an increase in wage and contribution through out the 40 yrs ? Obviously the buying power at the end of the 40 yr period will not be as it is now. I think I saw somewhere that on average it will be about 1/3 over a 40 yr period so in 40 yrs like 330 k now

Getting there but not enough in my view.

I absolutly have. Every bone in my invstment body is about maintaing purchasing power.

Over time I can explain the model. Some finacial savy will be required to understand it.

The model is using a REAL interest rate [a rate achieved after covering tax, investment expenses and wage increases(my inflation proxy)]

Contributions need to stay a fixed 7.2% of the ever changing average wage.

Craft.

How do you feel about the all eggs in one basket argument.

A severe event could leave a period of much lower growth than

Indicated. That period could impact massively on those at retirement

And those with a plan like yours.

Imagine a 10 yr period of no growth or even negative!

A good question. Personally, for a 40 year accumulation then perpetual income stream plan, I wouldn't dream of any other allocation - but I have a wealth of historical data and understanding of first principle economic components that drive future real returns that alleviate many concerns that others may hold.

It's the fear that stops people achiving solid results and causes them to hold far inferior long term assets and adopt far inferior strategies.

Your type of questions are the sort of questions that need to be discussed in depth to stress test the assumptions and get comfortable with the plan. But I'm not going to answer it with justice today. I'll come back to it and maybe in the meantime you might get some others people's thoughts as well.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,521

All eyes willing to learn

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Drillingt down to what is actual, the weekly average in the hand $1000. How do these figures stack up as average living costs per week for one person -

Rent = $250

Car Loan = $100

Food/Household items (including snacks, takeaways and things for the home) = $200

Utilities (averaged including qrtly. bills) = $70

Fuel = $30

Sport = $30

Recreation = $50

= $730 leaving $270 per week left over.

In the event this person remains at home for most of the non work time, does not have any medical needs, does not have any replacement costs and remains sane, after 1 year of saving they should have over $14000 saved.

Rent = $250

Car Loan = $100

Food/Household items (including snacks, takeaways and things for the home) = $200

Utilities (averaged including qrtly. bills) = $70

Fuel = $30

Sport = $30

Recreation = $50

= $730 leaving $270 per week left over.

In the event this person remains at home for most of the non work time, does not have any medical needs, does not have any replacement costs and remains sane, after 1 year of saving they should have over $14000 saved.

- Joined

- 24 February 2013

- Posts

- 820

- Reactions

- 1,367

Craft I think the elephant in the room in regards to your table is that assumption that a young person today will have access to their super at age 63.

I think with the way things are heading in regards to legislation that someone in their 20s now by the time they reach old age the goalposts will have been moved and they will likely have to be 75 or older to access their super. The reality is for most people the utility of money is way less at 75 than it was at 65. How many people can hike up a mountain when they go on an overseas holiday at age 75?

Also your assumed dividend return of 5.25% is that grossed up yield or after tax yield?

I think with the way things are heading in regards to legislation that someone in their 20s now by the time they reach old age the goalposts will have been moved and they will likely have to be 75 or older to access their super. The reality is for most people the utility of money is way less at 75 than it was at 65. How many people can hike up a mountain when they go on an overseas holiday at age 75?

Also your assumed dividend return of 5.25% is that grossed up yield or after tax yield?

- Joined

- 5 March 2008

- Posts

- 951

- Reactions

- 141

Thank you Craft for putting up your spreadsheet.

I have a great issue with the starting salary of $1553.1 pw or $79, 940 gross for an "average" 23 -24 year old. Way too high IMHO.

I base this on a professional son in law and a daughter of mine, both with exceptional marks at uni in fields where they easily found employment in their fields. Neither are (or were in my daughter's case, the 2 not a couple), had or have salaries anywhere near your starting one. Both are very above average!!

Average full time weekly earnings is skewed towards higher incomes, and most importantly later in life, so the effect of long term compounding, does not work as well, when people do climb the ladder of success later in life, but have less time for compounding to work.

The statistics themselves are skewed....

"4 All wage and salary earners who received pay for the reference period are represented in the AWE survey, except:

5 Also excluded are the following persons who are not regarded as employees for the purposes of this survey:

Excluding a lot of lower paid workers (agriculture, forestry and fishing), and making the series "full-time", when 54% of females working are in part-time or casual employment, really skews the term "average".

An average person in this country certainly does not start at 23-24 on $80k. Nor does the average person have a degree, with only 48% of 25-35yo having a higher than secondary education (2015) well up on the 33% for 55-65yo people, but still less than 50%.

Unfortunately, starting with a number way too high will skew the overall result, making it look 'easy'.

I have a great issue with the starting salary of $1553.1 pw or $79, 940 gross for an "average" 23 -24 year old. Way too high IMHO.

I base this on a professional son in law and a daughter of mine, both with exceptional marks at uni in fields where they easily found employment in their fields. Neither are (or were in my daughter's case, the 2 not a couple), had or have salaries anywhere near your starting one. Both are very above average!!

Average full time weekly earnings is skewed towards higher incomes, and most importantly later in life, so the effect of long term compounding, does not work as well, when people do climb the ladder of success later in life, but have less time for compounding to work.

The statistics themselves are skewed....

"4 All wage and salary earners who received pay for the reference period are represented in the AWE survey, except:

- members of the Australian permanent defence forces;

- employees of enterprises primarily engaged in agriculture, forestry and fishing;

- employees of private households;

- employees of overseas embassies, consulates, etc.;

- employees based outside Australia; and

- employees on workers' compensation who are not paid through the payroll.

5 Also excluded are the following persons who are not regarded as employees for the purposes of this survey:

- casual employees who did not receive pay during the reference period;

- employees on leave without pay who did not receive pay during the reference period;

- employees on strike, or stood down, who did not receive pay during the reference period;

- directors who are not paid a salary;

- proprietors/partners of unincorporated businesses;

- self-employed persons such as subcontractors, owner/drivers, consultants;

- persons paid solely by commission without a retainer; and

- employees paid under the Australian Government's Paid Parental Leave Scheme."

Excluding a lot of lower paid workers (agriculture, forestry and fishing), and making the series "full-time", when 54% of females working are in part-time or casual employment, really skews the term "average".

An average person in this country certainly does not start at 23-24 on $80k. Nor does the average person have a degree, with only 48% of 25-35yo having a higher than secondary education (2015) well up on the 33% for 55-65yo people, but still less than 50%.

Unfortunately, starting with a number way too high will skew the overall result, making it look 'easy'.

Drillingt down to what is actual, the weekly average in the hand $1000. How do these figures stack up as average living costs per week for one person -

Rent = $250

Car Loan = $100

Food/Household items (including snacks, takeaways and things for the home) = $200

Utilities (averaged including qrtly. bills) = $70

Fuel = $30

Sport = $30

Recreation = $50

= $730 leaving $270 per week left over.

In the event this person remains at home for most of the non work time, does not have any medical needs, does not have any replacement costs and remains sane, after 1 year of saving they should have over $14000 saved.

The plan I have outlined using salary sacrificing of 7.2% means an in hand reduction of only $3,754.04 per year on current figures.

You've identified a potential $14,000 - looking forward to seeing you plan with that amount of contribution available the result could be monumental!

Thank you Craft for putting up your spreadsheet.

I have a great issue with the starting salary of $1553.1 pw or $79, 940 gross for an "average" 23 -24 year old. Way too high IMHO.

Making a good point brty.

I could stage the wage over life, less early on and more later on to average out the same and the model would produce a different runway of yearly targets.

I mentioned that if you never achieved average wages then making 75% of average would require a higher % of your wage - but the 7.2% of what ever you do earn would give you approximately the equivalent of what you are used too.

Could muck around with a different wage progression rate in due course - but in the mean time I would be interested to know real life experiences compared to this flight path for the constantly at average wage over life assumption.

Are you any where near targets?

Do you generally have a higher saving capacity because of less comitment when young despite the lower wages?

The plan assumes no savings at all at age 23 - how valid is this? do people generally have some savings by then?

These two points are potentially big mitigating factors if you are not achieving average wages early in your career.

- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Craft this is excellent.

Tech/A - The inflation thing caught me off guard as well and it took me a coffee to realise that the table is not reflecting future returns, the table is to be used to compare ourselves to where we are at right now.

Craft, I have questions:

- Am I correct that you have noted that income paid out of your superannuation fund is tax free? I was not aware of this and further highlights the importance of having the funds in your super fund as opposed to personal name. I will continue to research this as this has a huge impact on how one should plan. It also gets me thinking about inheritance and a whole bunch of other issues directly or indirectly related to where long term investments should be kept.

- Can you expand on the real rate of return of assumption? Does that 4.25% include 5.25% in dividends (in which case it feels a fraction low) or not include dividends (in which case it feels a fraction high)

Other comments:

- The income required is going to vary depending on life situations. The retired married couple who own their own home and don't travel past the coast as a holiday destination couldn't spend 120k a year if they tried. Alternatively a renter living by themselves with health issues will need every bit of 60k

- I think this model goes in the face of the 'typical' Australian path and I love it. For so long the theme has been, buy the house, pay off the house whilst super builds, down size the home as a CGT free event and live off the balance + super. For me I think 25 year olds should be far more exposed to equities in Australia as I believe the next 25 years offers far more potential in this space.

- The assumption of never needing to drawdown on capital is a big one. This is my goal but if others in their old age are happy to drawdown over time it most likely reduces the total value needed (although admittedly impacts how the funds should be invested also I would argue)

In answer to your questions, I'll use my wife as I'm a unique case:

- My wife is smack bang on those superannuation targets, has a degree, is switched on, has worked hard in the public health care system. Earns an above average but not significantly so. Has never salary sacrificed and is money conscious (but not as frugal as me

- Absolutely we have a higher savings ability. I think a key issue here is the 22-25 year old grouping who are living at home should be saving 10-25k a year and simply dont.

- Most don't have savings at 23 but I would argue this distribution is wide. Some don't have savings because they've had to lease a car or pay for a lot of things themselves since they were 16, others don't have savings because they spend 250 at the pub each Friday & Saturday.

Tech/A - The inflation thing caught me off guard as well and it took me a coffee to realise that the table is not reflecting future returns, the table is to be used to compare ourselves to where we are at right now.

Craft, I have questions:

- Am I correct that you have noted that income paid out of your superannuation fund is tax free? I was not aware of this and further highlights the importance of having the funds in your super fund as opposed to personal name. I will continue to research this as this has a huge impact on how one should plan. It also gets me thinking about inheritance and a whole bunch of other issues directly or indirectly related to where long term investments should be kept.

- Can you expand on the real rate of return of assumption? Does that 4.25% include 5.25% in dividends (in which case it feels a fraction low) or not include dividends (in which case it feels a fraction high)

Other comments:

- The income required is going to vary depending on life situations. The retired married couple who own their own home and don't travel past the coast as a holiday destination couldn't spend 120k a year if they tried. Alternatively a renter living by themselves with health issues will need every bit of 60k

- I think this model goes in the face of the 'typical' Australian path and I love it. For so long the theme has been, buy the house, pay off the house whilst super builds, down size the home as a CGT free event and live off the balance + super. For me I think 25 year olds should be far more exposed to equities in Australia as I believe the next 25 years offers far more potential in this space.

- The assumption of never needing to drawdown on capital is a big one. This is my goal but if others in their old age are happy to drawdown over time it most likely reduces the total value needed (although admittedly impacts how the funds should be invested also I would argue)

In answer to your questions, I'll use my wife as I'm a unique case:

- My wife is smack bang on those superannuation targets, has a degree, is switched on, has worked hard in the public health care system. Earns an above average but not significantly so. Has never salary sacrificed and is money conscious (but not as frugal as me

- Absolutely we have a higher savings ability. I think a key issue here is the 22-25 year old grouping who are living at home should be saving 10-25k a year and simply dont.

- Most don't have savings at 23 but I would argue this distribution is wide. Some don't have savings because they've had to lease a car or pay for a lot of things themselves since they were 16, others don't have savings because they spend 250 at the pub each Friday & Saturday.

Craft, I have questions:

- Can you expand on the real rate of return of assumption? Does that 4.25% include 5.25% in dividends (in which case it feels a fraction low) or not include dividends (in which case it feels a fraction high)

The long run (100+ year) nominal return (not including franking) for the ASX is 10.6%.

The approx. split is 6% capital growth and 4.6% dividend (not including franking) return.

The 5.25% yield is a nominal yield. It is what the capital actually yields in today’s terms.

My rational for choosing 5.25% was to look at historical and future economic drivers and ease it back a tad to be conservative.

It is made up of a 4% dividend return and a 1.25% imputation credit (assuming 75% franking)

This is lower than historical (if franking is included), lower than the approx. 5.5% grossed up currently available and we are currently slightly below where regressed dividend yield to economic drivers would place it on average.

I’ll try explaining the Real yield using the historical numbers.

The long-term rate as explained above is 4.6% dividend + 6% capital. = total 10.6% (before franking)

We are now in a franking regime world and market wide dividends are on average franked about 75% which would add about 1.5% in franking credit value not captured in the calculation of the 10.6% So a total gross nominal return of approx. 12.1%

We want to adjust this 12.1% downward to take account of:

Tax: our dividends 4.6%+1.5% franking credit are taxed at 15% in the super account this eliminates (4.6%+1.5%) x 15% = 0.9% of our nominal return.

Expenses: expenses come out of our nominal returns – subtract 0.5% of our nominal return for expenses.

Maintaining purchasing power: we have to maintain or purchasing power out of our nominal return. The long-term inflation rate has been 3.8% and productivity improvements about 1.6%. Given wages over the long term compensate for inflation and share productivity gains with capital. I estimate long term wage growth has been about (50% x 1.6%) + 3.8% = 4.6%. (luckily we are going to buy and hold, so we don't have to wory about funding tax obligations on this growth)

So real return historically = 12.1% - 0.9%(tax) -0.5%(expenses) -4.6%(wage growth) = ~ 6%.

I have chosen 4.25% to be conservative and because some of the economic drivers going forward like population growth and productivity might be weaker than history. Being invested 100% in equities for the long hall, Inflation if it spikes back up isn’t really that big problem for us because ‘long run’ (although with a nasty lag) inflation will roughly increase the nominal return by a similar rate that we have to deduct to maintain purchasing power. On the other hand, increasing inflation from this low point will destroy cash and bonds over the long term - forget the housing bubble, its only one symptom of the bond bubble.

So there you go – rate assumptions should be clear as mud now.

Triathlete

Keep it Simple..!

- Joined

- 10 November 2014

- Posts

- 638

- Reactions

- 88

Nice work Craft......Just to add another perspective in regards to cash flow taking a look at corporate bonds senior debt and depending on how much risk people are willing to take having a combination of 55% investment grade and 45% non rated it is possible with a combination across Floating rate notes, Fixed coupon bonds and index annuities to increase the final capital of $1,142,003 to produce a cash flow of $94,786.00 or $7899 a month just something to think about in regards to another asset class.I was thinking about working through each of the variable estimates required in detail prior to putting up any model outcome, however somehow, I think I may have lost the interest of a lot who have already concluded the task was going to be too far out of reach if I went that avenue. So, I have made preliminary estimates for the variable required. I think they are realistic and defensible estimates and this is the flight plan outcome of modelling those estimates.

View attachment 72067

The average wage multiple is fixed – the Capital and Dividend Stream targets will ratchet up as average wage increases. This table is based on current average weekly earnings @ $1533.10

For the average wage earner, the modelled plan requires a salary sacrificed 7.2% of gross wage contribution every year to meet the target. (plus your standard 9.5% Employer superannuation guarantee amount)

For each age in the above table, there is a capital and dividend stream amount. Because Price/Dividend ratios fluctuate over time, In assessing your current situation against the plan you would need to have both stock(capital) and flow(dividend) above their respective target amounts before you could think about reducing the 7.2% contribution rate and still achieve the targeted outcome. If you are below these amounts you will need higher than 7.2% contributions going forward to catch up.

The 75% target would be tax free and in disposable income terms (currently $59,955) would be slightly more than the disposable pre-retirement income of $57,059.80.

Gross Salary $79,940.21

Less Salary Sacrifice $(5,731.36)

Taxable $74,208.85

Less Tax $(15,664.88)

Less Medicare $(1,484.18)

Disposable $57,059.80

If you are on less than average wage then achiving 75% of average wage requires a lot higher % of your income. Howere that same consistent ~7.2% sacrifice of your actual gross wage will stiil produce around the equivalent disposable retirement income as your pre-retirement disposabe wage.

The variable assumptions made:

Real rate of return: 4.25%

Nominal yield: 5.25% (including franking)

Asset class:

100% Equities.

Tax structure:

Superannuation.

Investment vehicle:

Broad, Low Coast, Non-synthetic Exchange Traded Equity Fund.

Key Consideration:

Volatility risk: Dividend flow has some volatility around the 5.25% average return assumed. Can the income needs be flexed (vary living expenses or have other back-up reserves) during below average yields to ensure capital does not need to be drawn down? If not 100% equity allocation close to and during retirement is not appropriate due to sequence risk and this plan is not appropriate.

If people are interested in this sort of wealth plan we can work through validating the assumptions and strategy choices, the model workings etc to ensure the plan is realistic which will fortify people’s belief systems to stay the course in times of market duress. Because at the end of the day none of this is too hard with a few right choices and some consistent application – Its more an issue of understanding than anything else.

Obviously in retirement you would in all likely hood have 80% in investment grade bonds but having more of the investment grade annuities could help with the extra cash flow when changing your percentages in the portfolio..

I wouldn't touch bonds - or any currency based fixed long duration asset for that matter (no matter what the credit quality) with a barge pole, especially now unless I had some real liquidity needs above the dividend stream I can accumulate and then I would be looking at very short durations only - ie cash or near cash.Nice work Craft......Just to add another perspective in regards to cash flow taking a look at corporate bonds senior debt and depending on how much risk people are willing to take having a combination of 55% investment grade and 45% non rated it is possible with a combination across Floating rate notes, Fixed coupon bonds and index annuities to increase the final capital of $1,142,003 to produce a cash flow of $94,786.00 or $7899 a month just something to think about in regards to another asset class.

Obviously in retirement you would in all likely hood have 80% in investment grade bonds but having more of the investment grade annuities could help with the extra cash flow when changing your percentages in the portfolio..

Triathlete

Keep it Simple..!

- Joined

- 10 November 2014

- Posts

- 638

- Reactions

- 88

Fair enough...I wouldn't touch bonds - or any currency based fixed long duration asset for that matter (no matter what the credit quality) with a barge pole, especially now unless I had some real liquidity needs above the dividend stream I can accumulate and then I would be looking at very short durations only - ie cash or near cash.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,521

An extreme example move a year forward and make it the last 9 yrs!

Totally different

Totally different