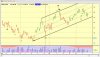

It's at a "turning point" I guess. While it's forming a double top, it's also an ascending triangle, plus it's above the 30 week m/a.

So, will it be 1. and ascending tri 2. a double/ triple top or 3. a sideways channel.

This week will be interesting.

So, will it be 1. and ascending tri 2. a double/ triple top or 3. a sideways channel.

This week will be interesting.