- Joined

- 28 August 2008

- Posts

- 94

- Reactions

- 0

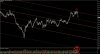

Re: USDCAD Looney

Good luck to you too.

Good luck with the trade.

Personally I'm looking for a long to add to my position but standing aside with all this volatility.

I've already tried twice but have been stopped out after a good profit both times.

The ranges on this thing!

Good luck to you too.