Kryzz

shaun

- Joined

- 12 May 2008

- Posts

- 491

- Reactions

- 92

ABT announced in pre market earlier this week lifting this and RBS almost to 2R trades now.

View attachment 85872

ABT announced in pre market earlier this week lifting this and RBS almost to 2R trades now.

View attachment 85872

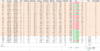

Portfolio update below, some positive earnings for ABT announced in pre market earlier this week lifting this and RBS almost to 2R trades now. Apple is due to report on Feb 1, will be tightening the stop slightly prior to this but will be holding through. (Most of my other holdings will be reporting later in Feb, will assess how things are looking then).

View attachment 85872

Yep, it sure was a week to remember and learn from. Having skin in the game makes the experience more valuable.

Imagine the performance of this portfolio if it started 9 years ago, right at the start of the US bull market. You still would have lost 7%, but you might have been up 200 - 400%. You would have laughed as you saw this panic selling and probably got ready to reload over the weekend to take full advantage of the likely rally.

Give me a few weeks to get sorted and I think I may tempt you back to the 4H forex markets.

Good, wont' be a problem with weekly charts. Check for scheduled earnings reports.recently increased risk per trade from 1 to 1.5% per trade

I've attached charts of VAR & ABCB for recent entries, pullback to the MAs with some consolidation on an old swing high. This is the primary setup I'm now looking for.

With all the opportunities in the US you should be able to find plenty of perfect setups. Don't take near-enoughs.

Do you look for the strongest sectors before choosing a stock?

I will need to amend my scans I think to cater for this, I note the lower price stocks tend to run harder (reviewing my recent CROX trade).Another aspect you may want to consider. Trade lower priced stocks. This will use less capital and you'll be able to start more trades when others are past their BE prices. More trades will allow you to be patient with those that go sideways for a few weeks.

I love that you're trading the weekly charts on the US markets. I like your thread and I want to see you earn some above average profits. I want you to get twice the SPY. If the SPY goes up 15% pa I want to see you get 30%.

I know you can do it. You've got two fantastic setups.

(i) BO - which will get you into a start of a trend

(ii) PB - the resumption of a trend.

I know you can position size correctly and your record keeping is good.

I'd like to see your W% and your AW, AL in R multiples for all your weekly trades (PM me?). You may think you haven't earned much so far. That doesn't matter. What matters is how are you going to improve? What minor changes will or have you made to improve your edge?

eg. Increasing trade risk to 1.5% won't improve your edge. It should produce more profit but only because you're risking more.

eg Adding a second setup (PB). This may improve your edge if the setup gets you into trades that move quicker (like ABCB moved from MAs to prior high, ka-ching grab the +1.4R, next trade)

Right now the US tech stocks and small caps are booming. Starting more trades* when the markets are very bullish will improve your edge. Starting fewer trades when market conditions are unfavourable will improve your edge.

Finding the next hot sector and jumping onto it near the start will definitely improve your edge. You'll need a process to identify the next hot sector. That's why I asked you about it.

I'm very positive about your trading efforts so far. I think you're close to really getting it.

* lower price stocks, leverage x2

. I wish I could utilize leverage with IB however from my understanding this is tricky for Aus customers. I think I would need to create a Pty Ltd company and sell down all positions and transfer AUD cash to the new a/c.

. I wish I could utilize leverage with IB however from my understanding this is tricky for Aus customers. I think I would need to create a Pty Ltd company and sell down all positions and transfer AUD cash to the new a/c.New long entered on Friday night with ATGE - breakout. Consumer discretionary sector made new all time highs two weeks ago, sector is looking strong. Earnings on 16/08.

View attachment 88215

New long (pullback trade) entered with NRG on Monday.

SSNC, NRG and SSNC all have earnings within the next fortnight, likely all these positions will be closed prior to then.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.