- Joined

- 28 March 2006

- Posts

- 3,554

- Reactions

- 1,283

Agree with the speaker in the video. Pretty much sums it up.

Second video.

Interesting comment of investing into China as the US $ is on the nose.

My basic thought is that it means the recession hasn't done what it needed to do.How that pans out is anyone's guess IMO, uncharted waters at the moment.

Yes, in actual fact, it was the technical recession that wasn't a recession. It really is uncharted waters, I don't think even the experts know what comes next.My basic thought is that it means the recession hasn't done what it needed to do.

The dead wood's still on the tree and will hamper future growth.

The Fed and other major central banks are likely to avoid rushing into rate hikes. Major central banks fear that jumping at what should be a transitory spike in inflation will risk slowing recovery prematurely and repeat the mistakes of recent times. They would rather look through any spike in inflation and allow the recovery to continue until full employment is reached, generating higher wages growth which may be a few years away – Australia needs 3% plus wages growth to be consistent with inflation at target whereas it’s now just 1.5%.

The Fed and RBA will likely follow the Bank of Canada & Bank of England in slowing bond buying – but this is not monetary tightening and if they remain dovish on interest rates as expected it will mean any near-term inflation-driven bond market panic & hit to share markets will likely be short lived. Key to watch will be inflation expectations and wages growth.

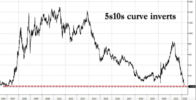

I've been watching Steve Van Metre who makes some interesting cases on all this,based on bond market action.But is it transitory? Many fear the "genie escaping from the bottle".

.... who makes some interesting cases on all this,based on bond market action.

View attachment 127325

BREAKING! US core #inflation rose to 4.5% in June, higher than expected and the highest level since 1991. Headline #CPI also higher than expected at 5.4%!

So, the US fed finally raises rates, and says that there will be at least six more to get rates to 2% by the end of the year, so that they can curb the rampant inflation in the US.

So what is the markets response.

The DOW up 500+ points and the NASDAQ just shuy of the same figure - definitely not expected.

Gold jumps up - expected.

The US dollar falls, not expected.

The AUD v USD pair drops nearly 2% definitely not expected.

The fed belatedly admits there is a problem with inflation, and all the markets think its great.

It is a weird world.

Mick

But the trouble is that with rate at 2% or 4 % or 6%..does not matterI think the concern was a 0.5% hike, hence the rally. Even at rates of 2% pa money would still be better off in equities

Inflation will always exist, but I'm not so sure on hyperinflation. The price of oil has been more volatile than I expected it to be... We are staring at POO being cheaper than pre-Ukraine invasion!!!! The same applies to wheat (which also doubled post invasion).But the trouble is that with rate at 2% or 4 % or 6%..does not matter

Inflation will remain loose and we are going into hyper inflation..not good for stocks or currencies

US equities initially pared gains once the rate hike decision was announced, but resumed their rally during/after Jerome Powell's speech. So perhaps the reason for the strong rise came on the back of the confidence Powell showed in regards US economy, especially as recession fears have been on the rise.So, the US fed finally raises rates, and says that there will be at least six more to get rates to 2% by the end of the year, so that they can curb the rampant inflation in the US.

So what is the markets response.

The DOW up 500+ points and the NASDAQ just shuy of the same figure - definitely not expected.

Gold jumps up - expected.

The US dollar falls, not expected.

The AUD v USD pair drops nearly 2% definitely not expected.

The fed belatedly admits there is a problem with inflation, and all the markets think its great.

It is a weird world.

Mick

but hold on .. weren't they stripping out 'volatile ' factors like food , fuel/energy and rent prices when the CPI was rising

Consumers expect inflation to slow down, a big win for the Fed

The consumer outlook for inflation tumbled in July amid a sharp drop in gas prices and a belief that the surges in food and housing also would ebb.www.cnbc.com

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.