Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,583

- Reactions

- 12,103

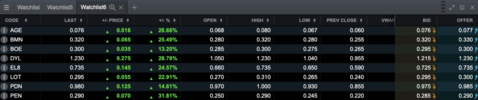

Hmmm, bit of a scattered irregular rotate today.

Money flying all other directions, mostly.

Yeah, no idea. Maybe just locking in the short term gains for a retreat and then the next push. The whole sector, including overseas, has run ahead of itself. SPUT buying and the POU up 10% or so the past couple of weeks was the catalyst. There's expectations that it's not a one off and the price will continue to rise, but maybe not that sharply. There's some crazy bullish comments on social media from 'experts' claiming $200 going down the track, which sounds a bit insane to me. I can't imagine a spike like we had back in 2005-08 ish. Maybe that little rally was it and the money goes back to Bit Coin?