- Joined

- 28 May 2020

- Posts

- 7,086

- Reactions

- 13,798

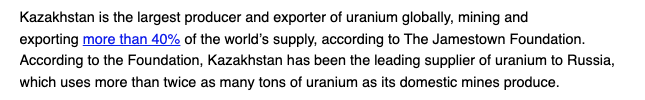

I was a bit surprised to learn that Borats home Kazakhstan, is the largets producer of uranium.

From Oil price.com

That last sentence also took me by surprise.

I had always assumed, obviously wrongly, that Russia produces all of its uranium supply for domestic use and then some.

perhaps that might have been true when Borats home was part of the USSR.

But to add to the drama, it seems that supply from Kazakhstan might not meet production targets.

From the same article

Looks like there will be plenty of legs in the uranium market yet.

And of course, here in OZ, all the experts have written off nuclear as yesterdays technology.

Lucky for us, our experts are superior to all the other experts in other countries.

Mick

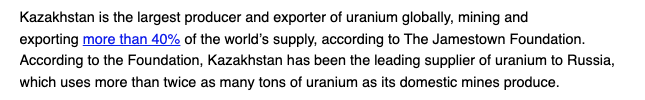

From Oil price.com

That last sentence also took me by surprise.

I had always assumed, obviously wrongly, that Russia produces all of its uranium supply for domestic use and then some.

perhaps that might have been true when Borats home was part of the USSR.

But to add to the drama, it seems that supply from Kazakhstan might not meet production targets.

From the same article

Looks like there will be plenty of legs in the uranium market yet.

And of course, here in OZ, all the experts have written off nuclear as yesterdays technology.

Lucky for us, our experts are superior to all the other experts in other countries.

Mick