Yes they are also building nuclear reactors throughout Africa. In the case of LLL I'm sure Wagner was on the ground at the lithium site during the dispute. The West is losing influence in these areas.I saw something recently where Wagner, the private Army in Russia, is very active in these areas, and specifically looking to snare Uranium.

Uranium

- Thread starter Inklings

- Start date

- Joined

- 28 May 2020

- Posts

- 7,086

- Reactions

- 13,798

Uranium miners took a hit last night after state-owned miner Kazatomprom released an update on operations and trading on Thursday, indicating it now expects to produce between 22.5mln and 23.5mln metric tons of uranium this year, while it previously stated the range of 21mln and 22.5mln tons.

"The Company is increasing its 2024 full-year production guidance on both a 100% and attributable basis as the half-year results show that the production rates with which the mining entities are now progressing will result in higher than initially expected volumes. As was previously disclosed, the Company was able to secure necessary volumes of sulphuric acid required for its 2024 production at minus 20% level relative to Subsoil Use Agreements," Kazatomprom said.

The upward revision comes after a 5% and 6% rise in second-quarter and half-year output, respectively, the miner noted in the update. It added that sales volumes soared 48% in the second quarter, mainly due to the timing of customer-scheduled

Mick

"The Company is increasing its 2024 full-year production guidance on both a 100% and attributable basis as the half-year results show that the production rates with which the mining entities are now progressing will result in higher than initially expected volumes. As was previously disclosed, the Company was able to secure necessary volumes of sulphuric acid required for its 2024 production at minus 20% level relative to Subsoil Use Agreements," Kazatomprom said.

The upward revision comes after a 5% and 6% rise in second-quarter and half-year output, respectively, the miner noted in the update. It added that sales volumes soared 48% in the second quarter, mainly due to the timing of customer-scheduled

Mick

- Joined

- 28 May 2020

- Posts

- 7,086

- Reactions

- 13,798

Uranium rises again after the biggest producer of uranium Kazatomprom announced a cut in forecast production.

From Zero Hedge

Mick

From Zero Hedge

Mick

- Joined

- 24 July 2021

- Posts

- 248

- Reactions

- 746

I wonder why Kazatomprom previously announced they were going to increase production as mentioned in an earlier post and now the company is saying they are going to cut production and the effect on the uranium price.

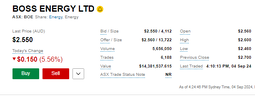

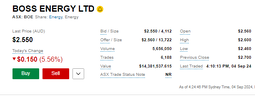

I took advantage of the price dip and bought a second parcel of shares of Boss Energy.

I took advantage of the price dip and bought a second parcel of shares of Boss Energy.

- Joined

- 17 August 2006

- Posts

- 8,085

- Reactions

- 8,887

I see you were on to this early Mick @mullokintyre

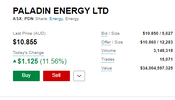

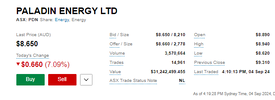

A few Uranium Stocks getting the benefit of some Specking off the back of it today

A few Uranium Stocks getting the benefit of some Specking off the back of it today

- Joined

- 8 March 2007

- Posts

- 3,137

- Reactions

- 4,402

It was Old News and Unfortunately Most Gapped up 10%-17% on the OPEN

- Joined

- 17 August 2006

- Posts

- 8,085

- Reactions

- 8,887

Yes a crystal ball would be nice at times CC.It was Old News and Unfortunately Most Gapped up 10%-17% on the OPEN

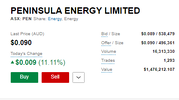

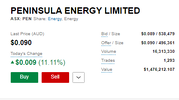

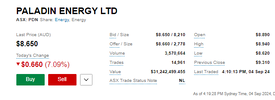

I was lucky enough to pick up a few PEN late last week based on the oversold chart ... That didnt make up for the fact I sold the remainder of another stock out of frustration just before it finally moved up after an "age"

Given the extent of Kazatomprom's influence on the U market, there could be a few trading opportunities with ASX U stocks over the next 12 months. Maybe an inside day tomorrow on some of the risers? .... but more upside would definitely not surprise.

- Joined

- 17 August 2006

- Posts

- 8,085

- Reactions

- 8,887

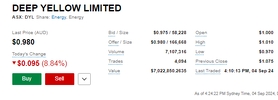

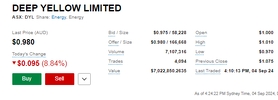

What a difference a few days makes ....

How's that old Buffett ? saying go "be fearful when others are greedy, and greedy when others are fearful"

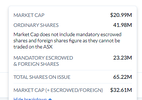

Of all the below Stocks PEN looks decidedly more "beaten up" against the futures price.

I bought a few more PEN today with a mid/longer term view. Time will tell if that was smart or not

How's that old Buffett ? saying go "be fearful when others are greedy, and greedy when others are fearful"

Of all the below Stocks PEN looks decidedly more "beaten up" against the futures price.

I bought a few more PEN today with a mid/longer term view. Time will tell if that was smart or not

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,816

- Reactions

- 12,691

Anyone here liking I88 "Infini Resources"

biggest soil sample ua3 readings.

progressing toward drilling soon.

Would have liked it before it went 10 X.

Now, no idea.

Maybe post something in the I88 thread.

- Joined

- 21 November 2022

- Posts

- 389

- Reactions

- 989

I88 is a frustrating one for me , sold down under 6 month old IPO that came up on a tax loss sold screen late June , this year . Made my short list to buy BUT then was halted so no cigar ... That close to a near instant 5 bagger , not that would have bought many . The soil sample grades seem great , like almost too good to be true great . I am such a cynic about soil/rock chip samples i couldnt buy it up here . Thats the kiss of death right here and it will likely be a huge thing , haha . Cigar Lake in Canada had the best ever U grades so that sticks in my mind a bitWould have liked it before it went 10 X.

Now, no idea.

Maybe post something in the I88 thread.

I88 is a frustrating one for me , sold down under 6 month old IPO that came up on a tax loss sold screen late June , this year . Made my short list to buy BUT then was halted so no cigar ... That close to a near instant 5 bagger , not that would have bought many . The soil sample grades seem great , like almost too good to be true great . I am such a cynic about soil/rock chip samples i couldnt buy it up here . Thats the kiss of death right here and it will likely be a huge thing , haha . Cigar Lake in Canada had the best ever U grades so that sticks in my mind a bit

Well worth a look if you havent checked them already.

Here is a decent low down on the Infini Resources potential from a professional geologist point of view, done soon after I88 initial high grade samples presented.

Plus a short follow up vid done a little latter on.

GeoInvest Episode 23: Infini Resources

Follow up on I88

Exactly Barney,

That's what is to like about them essentially, with the great prospect for a massive strike of U3O8, there is plenty of upside potential at the current Shares On Issue and such a low market cap, lots of room to move upward, still available.

- Joined

- 19 October 2005

- Posts

- 5,247

- Reactions

- 7,988

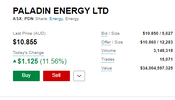

Market Matters afternoon report:

- Uranium stocks were solid with Paladin (PDN) + 4.7%, Deep Yellow (DYL) +5.1% & Boss Energy +8.2% after Constellation Energy (CEG US) signed a 20-year power purchase agreement with Microsoft which will restart Three Mile Island Unit 1, a nuclear power plant that shut down in 2019. This sort of deal highlights the importance of Nuclear in powering the high-intensity energy requirements for Data Centres., with MSFT signing up to buy 100% of its power for 20 years

- Joined

- 8 June 2008

- Posts

- 13,904

- Reactions

- 20,843

The captain @Captain_Chaza had a great Uranium Sailing fleet deployed today, but as many I am sure, the open gap was too high for my orders and I only managed to get SILEX.

I left some U238 open order just in case of a volatile week but I suspect my odds are low

I left some U238 open order just in case of a volatile week but I suspect my odds are low

- Joined

- 20 July 2021

- Posts

- 12,935

- Reactions

- 17,933

i hope MSFT aren't writing the software for controlling those power stationsMarket Matters afternoon report:

Not Held

- Uranium stocks were solid with Paladin (PDN) + 4.7%, Deep Yellow (DYL) +5.1% & Boss Energy +8.2% after Constellation Energy (CEG US) signed a 20-year power purchase agreement with Microsoft which will restart Three Mile Island Unit 1, a nuclear power plant that shut down in 2019. This sort of deal highlights the importance of Nuclear in powering the high-intensity energy requirements for Data Centres., with MSFT signing up to buy 100% of its power for 20 years

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,280

- Reactions

- 8,551

Fortescue is enough exposure for me, there is more steel in nuclear power plants than their is uranium, even the nuclear fuel rods themselves and their dry casks contain more steel than uranium.BHP mines some .. that is enough exposure for me thanks

if uranium has a long-term path forward BHP will expand the already existing assets

- Joined

- 20 July 2021

- Posts

- 12,935

- Reactions

- 17,933

Nuclear Is Back: PA Governor Shapiro Pushes For “Fast Track” Re-Open For Three Mile Island

Nuclear Is Back: PA Governor Shapiro Pushes For “Fast Track” Re-Open For Three Mile Island | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

.. and if things could go wrong , why not increase the chances of it ( here comes corruption )

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,682

- Reactions

- 6,993

Market Matters afternoon report:

Not Held

- Uranium stocks were solid with Paladin (PDN) + 4.7%, Deep Yellow (DYL) +5.1% & Boss Energy +8.2% after Constellation Energy (CEG US) signed a 20-year power purchase agreement with Microsoft which will restart Three Mile Island Unit 1, a nuclear power plant that shut down in 2019. This sort of deal highlights the importance of Nuclear in powering the high-intensity energy requirements for Data Centres., with MSFT signing up to buy 100% of its power for 20 years

Techncially, uranium sales should be going up at a good rate due to the number of nuclear power stations being build and in the planning phase.

However, there is other factors to take into account: improved efficiency, new mining sites coming on line leading to higher competition, voters against nuclear, improved pricing of renble infrastructure. Though there is also the other side, which includes poor reneable costs, increased demand on nuclear stations, voter change.

About 440 reactors with combined capacity of about 390 GWe require some 80,000 tonnes of uranium oxide concentrate containing about 67,500 tonnes of uranium (tU) from mines (or the equivalent from stockpiles or secondary sources) each year. This includes initial cores for new reactors coming online. The capacity is growing slowly, and at the same time the reactors are being run more productively, with higher capacity factors, and reactor power levels. However, these factors increasing fuel demand are offset by a trend for increased efficiencies, so demand is dampened – over the 20 years from 1970 there was a 25% reduction in uranium demand per kWh output in Europe due to such improvements, which continue today.

Uranium Markets - World Nuclear Association

Production from world uranium mines has in recent years supplied 90% of the requirements of power utilities. Primary production from mines is supplemented by secondary supplies, principally by ex-military material.

world-nuclear.org