Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,278

- Reactions

- 11,529

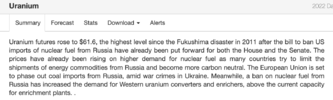

The uranium resurgence has stalled the past three months after the amazing run up in September. All the juniors have come well off, tracked sideways and down and some breaking some key support levels. Fairly bullish looking flag set up here on the longer term chart. Possibly an opportunity soon if she does break up for those who missed the first run and if we believe the longer term nuclear narrative.