- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 33

The US is crashing, it's only the afterglow of continuous QE that keeps it going, but you would never know it by the way 'retail' analysts measure economic recovery success by - the Dow Jones index?

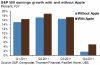

Another measure - AAPL Apple - headline numbers look good but nearly all of it was from a one of to some stupid company buying 3 years worth of iPhones - hitting an air pocket soon?

Employment - those that know how the stats are calculated know that at best it's a guesstimate - there is a huge fudge factor put in as well as other fudges eg birth/death ratio etc - they probably actually lost a million jobs! The real unemplyment rate is closer to 12%, the total unemployed rate is closer to 18% - straight from the Feds mouth here - http://research.stlouisfed.org/pdl/458

This bloke knows the numbers and he's confused -

US Railfreight is going down

http://railfax.transmatch.com/

Negative real wage growth.

House prices firmly continuing down on the second dip.

Baltic Dry Index is plunging - 1 shipping line is actually paying a customers fuel costs just to use their ships!

Then the Euro zone, China & of course the Japan!

Only those 'glass half full' types are blind to reality, but will have the biggest dissapointement when economic gravity, ie reverting to humanities mean, finally arrives?

Another measure - AAPL Apple - headline numbers look good but nearly all of it was from a one of to some stupid company buying 3 years worth of iPhones - hitting an air pocket soon?

Employment - those that know how the stats are calculated know that at best it's a guesstimate - there is a huge fudge factor put in as well as other fudges eg birth/death ratio etc - they probably actually lost a million jobs! The real unemplyment rate is closer to 12%, the total unemployed rate is closer to 18% - straight from the Feds mouth here - http://research.stlouisfed.org/pdl/458

This bloke knows the numbers and he's confused -

US Railfreight is going down

http://railfax.transmatch.com/

Negative real wage growth.

House prices firmly continuing down on the second dip.

Baltic Dry Index is plunging - 1 shipping line is actually paying a customers fuel costs just to use their ships!

Then the Euro zone, China & of course the Japan!

Only those 'glass half full' types are blind to reality, but will have the biggest dissapointement when economic gravity, ie reverting to humanities mean, finally arrives?

Last edited by a moderator: