Agent once again your what i refer to as an early entrant. It carries risk and reward. You learned this on ADI.

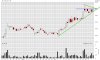

You where years to early on ADI and abandoned AUt at the exact wrong time. Your knowledge of the eaglefor is amazing, but so far your timing of investment in the eagleford has been questionable. I believe you got about 20c per share out of AUT and yet its actually grown from 25c to $1.48 int he time ve been in it.

In reference to AUT vs TXN, its simple AUT now are at a premium for a good reason, they have proven reserves, proven acerage, proven operator and multiple wells flowing to sales and about to be cash flow positive from those wells. Sure its growth curve will slow, temporarily, but as you well know in 2011, they have three rigs and a FT frac crew which should technically see almost 1.5 times the 2010 growth, all other factors being equal. 50 wells planned for 2011.

In contrast TXN is in the early stages. Presumably, but not certain its acerage is good, its operator skills ????? but heats the risk v reward trade off. IT is higher risk then AUt, but its also higher reward if it turns out to be great.

I have cast the net over all shale player and so far only SEA and AUT have enticed me to part with my cash.

You where years to early on ADI and abandoned AUt at the exact wrong time. Your knowledge of the eaglefor is amazing, but so far your timing of investment in the eagleford has been questionable. I believe you got about 20c per share out of AUT and yet its actually grown from 25c to $1.48 int he time ve been in it.

In reference to AUT vs TXN, its simple AUT now are at a premium for a good reason, they have proven reserves, proven acerage, proven operator and multiple wells flowing to sales and about to be cash flow positive from those wells. Sure its growth curve will slow, temporarily, but as you well know in 2011, they have three rigs and a FT frac crew which should technically see almost 1.5 times the 2010 growth, all other factors being equal. 50 wells planned for 2011.

In contrast TXN is in the early stages. Presumably, but not certain its acerage is good, its operator skills ????? but heats the risk v reward trade off. IT is higher risk then AUt, but its also higher reward if it turns out to be great.

I have cast the net over all shale player and so far only SEA and AUT have enticed me to part with my cash.