You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TXN - Texon Petroleum

- Thread starter surfingman

- Start date

-

- Tags

- texon petroleum txn

No shortage of oil in the world? You need to read a bit more - start with "Twilight in the desert" by Matt Simmons. Also have a look for those wikileaks cables regarding the Saudis alleged "spare capacity, or rather the lack thereof, especially light sweet (which Saudi production is not a good sustitute for, being heavy sour)

Great response.

The issue as i understand it is irrespective of whether your a peak oil subscriber or not, there is no shortage of oil in the world. We have over 100 years supply easy. The issue is the supply demand imbalance. We have hardly any spare capacity. They are drilling as fast as they can in as many places as possible and they are almost unable to keep up with demand. All it takes is little situations like a fire in Lybia or some other key supplier and bang. Demand outstrips supply and the price rockets as punters fret over missing out on supply.

Weve exhausted all the huge oil fileds that where in easy to drill, easy to transport, easy to operate locations close to markets.

We are no having to go further, into politically unstable areas, unsafe areas, deep and further and thats the issue. As the world economy ramps back up we are having trouble increasing supply, with the increase in demand.

Even a revolutionary breakthrough would take decades to test, plan, tool up, manufacture, and implement. As such for now we are going to see oil shocks imo every time there is a supply interuption. or potential one. Hurricane season will send shutters through world markets on an annual basis, as they threaten the gulf and southern states of the US annually.

This is just the begginning so enjoy the ride. Its a great time to be hedging petrol costs by owning some oil stocks, imo.

Oh yeh and when the IEA, the worlds biggest denyer of peak oil suddenly does a complete u-turn and says peak oil has already occurred , its time to at least consider it in your planning.

http://news.google.com.au/news/search?aq=f&pz=1&cf=all&ned=au&hl=en&q=iea+peak+oil

Havent got my paper work yet.

- Joined

- 13 December 2010

- Posts

- 135

- Reactions

- 0

Condog in your opinion which stock has more upside. TXN or SEA?

Sdajii

Sdaji

- Joined

- 13 October 2009

- Posts

- 2,130

- Reactions

- 2,271

Folks

The SPP offer was reported to have been despatched on 7 March.

I live in Perth and still have not seen it in my letter box

I was a holder on 22nd Feb to be eligible for the SPP.

Can any one please throw some light how long normally it takes to reach at letter box and if you have got it SPP offer I mean before I write to the company ?

Arrived today in Kinglake (just outside Melbourne metro postal area).

- Joined

- 2 May 2007

- Posts

- 4,734

- Reactions

- 2,986

I received paperwork today (in Melbourne). Don't know about Perth

Arrived today in Kinglake (just outside Melbourne metro postal area).

Thanks Folks for the update

Yes, I reached home now and found the SPP offer in the letter box.

I did not realise from Brisy to Perth mail takes 4 days.

Nevertheless, I am happy to apply for SPP and to get some cash sold out previous holding as soon as it became XR

Regards

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

i'm going to wait a couple of weeks to see what the market does before i jump in on the spp.

but i must say that txn has held relatively well compared to a number of other o&g stocks over the past week or so.. a sign of its value imho

this txn share wont play ball in terms of crash and burn like the entire sector is doing..

i mean a couple of lousy cents is all its mustered so far..

the possibility of a massive pull back on txn is right now not in the making.. but i am waiting patiently none the less..

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

ASX Release

11 March 2011

TENTH LEIGHTON OLMOS WELL - SUCCESSFUL

Texon advises that Tyler Ranch #8 has reached its total depth of 2,774 metres (9,100 feet). This is the tenth well in the Leighton oil and gas field – all of which have been successful.

The Olmos in Tyler Ranch #8 has similar reservoir characteristics to the Olmos in the previous nine (9) Leighton wells.

It is now planned to run production casing in the well after which the Olmos will be fracture stimulated in March and then the well will be connected for oil and gas production.

This was the third well in the current three well back to back Olmos production drilling program of Leighton and the drilling rig will now be released.

Texon has an 80% working interest (60% net revenue interest) in Tyler Ranch #8.

11 March 2011

TENTH LEIGHTON OLMOS WELL - SUCCESSFUL

Texon advises that Tyler Ranch #8 has reached its total depth of 2,774 metres (9,100 feet). This is the tenth well in the Leighton oil and gas field – all of which have been successful.

The Olmos in Tyler Ranch #8 has similar reservoir characteristics to the Olmos in the previous nine (9) Leighton wells.

It is now planned to run production casing in the well after which the Olmos will be fracture stimulated in March and then the well will be connected for oil and gas production.

This was the third well in the current three well back to back Olmos production drilling program of Leighton and the drilling rig will now be released.

Texon has an 80% working interest (60% net revenue interest) in Tyler Ranch #8.

this txn share wont play ball in terms of crash and burn like the entire sector is doing..

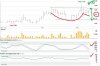

Agree, Agentm , I placed an order this morning at 74.5 and thank you, anyway further to my previous post, I managed to put together a ruff chart of the cup and handle formation I was speaking about.

Couple this with todays announcements I think we will be hitting the $1+ mark shortly.

thats my take, happy to hear from others.

Attachments

- Joined

- 4 February 2011

- Posts

- 53

- Reactions

- 0

re : the extraordinary general meeting about the ratification issue of new shares notice that came out today.

does that mean that the SPP may not go ahead after all?

does that mean that the SPP may not go ahead after all?

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

geelongfan

all is fine, it will go ahead

next announcement

11 March 2011

4 WELLS

MARCH 2011 TESTING

Eagle Ford

Texon advises that the fracture testing of its second Eagle Ford well (Teal EFS #1H) has been slightly delayed and is now scheduled to begin next week.

Texon has a 100% WI (75% NRI) in this well.

Olmos

Upon completion of the above project, the contractor will fracture stimulate the three (3) Olmos production wells referred to in the Company’s release of 19th January this year. These wells have now been drilled and the Olmos oil reservoir has been encountered as predicted in each well.

The frac work will take approx one (1) day per well. The wells will be placed in production when the fracture stimulation and testing are completed.

Texon has an average 70% WI (52.5% NRI) in these 3 wells.

Production

During the second quarter of this year, it is expected that the above four (4) wells, if successful will contribute a combined average of 600 boepd to the Company’s production.

impressive announcement imho

cheers

all is fine, it will go ahead

next announcement

11 March 2011

4 WELLS

MARCH 2011 TESTING

Eagle Ford

Texon advises that the fracture testing of its second Eagle Ford well (Teal EFS #1H) has been slightly delayed and is now scheduled to begin next week.

Texon has a 100% WI (75% NRI) in this well.

Olmos

Upon completion of the above project, the contractor will fracture stimulate the three (3) Olmos production wells referred to in the Company’s release of 19th January this year. These wells have now been drilled and the Olmos oil reservoir has been encountered as predicted in each well.

The frac work will take approx one (1) day per well. The wells will be placed in production when the fracture stimulation and testing are completed.

Texon has an average 70% WI (52.5% NRI) in these 3 wells.

Production

During the second quarter of this year, it is expected that the above four (4) wells, if successful will contribute a combined average of 600 boepd to the Company’s production.

impressive announcement imho

cheers

Good news yeh

lets wait see what the flows are, but if they are good this thing should rocket. As they showed the 60 day declines to be ok, after those dismal 30 day declines last time.

As far as SEA v TXN. They are entirely different. SEA has exposure to many many many wells but most are small %, so imo it caries less risk and les growth. TXN imo has more potential upside and more potential risk.

Thats about as good as i can put it, to say anything more definative would be guessing.

lets wait see what the flows are, but if they are good this thing should rocket. As they showed the 60 day declines to be ok, after those dismal 30 day declines last time.

As far as SEA v TXN. They are entirely different. SEA has exposure to many many many wells but most are small %, so imo it caries less risk and les growth. TXN imo has more potential upside and more potential risk.

Thats about as good as i can put it, to say anything more definative would be guessing.

I think what condog means by "less growth" is less rapidity in growth or slower growth, and the inverse of that - "more potential" meaning faster growth... at least just for the near future being this year, judging by their current state of affairs.

But both TXN and SEA have the potential for the same amount of growth (relative to market cap size of course) even though they're going about things very differently.

I hold both.

But both TXN and SEA have the potential for the same amount of growth (relative to market cap size of course) even though they're going about things very differently.

I hold both.

Bound to be some selling in the next few days. The SPP offer is in the mail and there are bound to be some who will sell now to fund the SPP at a cheaper price. The SPP will probably be over subscribed and possibly scaled back so caution is required.

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

texon has yet to put a production liner into the tyler ranch well.. its declines on the 5 1/2 inch casing is well in line with what you would expect.

introducing a production casing at 90 days in is something i was expecting to happen.

the flow rates on the well will be lower imho, and i can well expect the usual suspects to doom and gloom the heck out of them myself.

whats evident to me is that the volume of drilling in the county is increasing, with multiple completions all around the perimeter of the texon acreages

i am very upbeat on how texon is dealing with the multiple targets it has on the 6000 mcmullen acreages, there is also the coolangatta drill to commence as well as two efs wells in a row in about 50+ days...

texon is looking for many new targets, its beginning to wind itself up as they employ more and more in texas to bring it all on line..

Goal

‐40 High Quality Projects for Texon

Five 20mmboe type projects for 2012 drilling

looking forward to the months and the next few years ahead

fingers crossed the sp tanks some more,, i am happy to accumulate.. imho the market cap right now at $149 million for what it has in the tank is pretty good value.. well at least to me.. as imho many dont see the big picture ..

good luck to the sellers

introducing a production casing at 90 days in is something i was expecting to happen.

the flow rates on the well will be lower imho, and i can well expect the usual suspects to doom and gloom the heck out of them myself.

whats evident to me is that the volume of drilling in the county is increasing, with multiple completions all around the perimeter of the texon acreages

i am very upbeat on how texon is dealing with the multiple targets it has on the 6000 mcmullen acreages, there is also the coolangatta drill to commence as well as two efs wells in a row in about 50+ days...

texon is looking for many new targets, its beginning to wind itself up as they employ more and more in texas to bring it all on line..

Goal

‐40 High Quality Projects for Texon

Five 20mmboe type projects for 2012 drilling

looking forward to the months and the next few years ahead

fingers crossed the sp tanks some more,, i am happy to accumulate.. imho the market cap right now at $149 million for what it has in the tank is pretty good value.. well at least to me.. as imho many dont see the big picture ..

good luck to the sellers

In the grand scheme of things weve had a market pullback of around 5-7% and the japan situation, while horrible, isnt likely to cause massive problems globally unless they have a large scale radiation leak that drifts over China or Tokyo.

If anything now Japan is likely to have stronger economic activity in H2 2011 once the repair and reconstruction phase starts. They will need more Australian resources, more oil, more steel then normal to reconstruct and repair.

One only has to look at the fundamental intrinsic values of Australian companies to see we are over sold. All 4 banks are under value ranging from 13.3% for WBC to 23.7% for NAB. JBH is 37% under value, BHP 29% under value, woolworths 25%.

Im seeing good buying opportunities on a number of my stocks and am happily buying while others are selling. Im seeing the correction imo as having bottomed or close to bottomed and i like the value on offer with savings of 10-20% in the small cap oilers.

If anything now Japan is likely to have stronger economic activity in H2 2011 once the repair and reconstruction phase starts. They will need more Australian resources, more oil, more steel then normal to reconstruct and repair.

One only has to look at the fundamental intrinsic values of Australian companies to see we are over sold. All 4 banks are under value ranging from 13.3% for WBC to 23.7% for NAB. JBH is 37% under value, BHP 29% under value, woolworths 25%.

Im seeing good buying opportunities on a number of my stocks and am happily buying while others are selling. Im seeing the correction imo as having bottomed or close to bottomed and i like the value on offer with savings of 10-20% in the small cap oilers.

- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

Agentm , looks like you've seen your 0.68c,

you aint seen nothing yet

the rout is on in earnest.. so its a case of whom ever fills their sell orders the fastest

its a race to the bottom

right now is not the time to buy, wait until the bottom, then start picking at what ever you want

- Joined

- 21 May 2010

- Posts

- 224

- Reactions

- 9

For all those who missed the CR, nows your chance. Like other small cap oilers, for various reasons, sp normally retraces back to near CR price.

Was only a matter of time.

Was only a matter of time.

- Joined

- 13 December 2010

- Posts

- 135

- Reactions

- 0

I dont think thats the only reason Assassin, i think the fact the market is down 100 points and theres alot of uncertainty about a Nuclear Meltdown is the main reason the stock is down...

Similar threads

- Replies

- 38

- Views

- 5K