Good Morning,

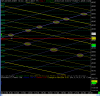

The SPI200 March 10 contract continued to trade within the development yesterday, rotating to 4892 in the opening phase to then rotate lower inside the development through the course of the session. An initiating sell tail triggered at 4841 late in the session to close at 4837.

The market developed in a 4817 to 4840 range in the first half of the night session. An early morning distribution extended the market lower to a rejecting responsive buy tail at 4781, that rotated the market higher to 4796 initially, then 4816 to close at 4810.

The market has made a new distribution lower overnight, with a temporary low now in place at the responsive sell tail 4781. The double distribution lower overnight indicates a bearish bias.

Key resistance is initially at 4815/16, 4822, prior development low 4829/33 and 4950/52.

Key support is initially at 4796, 4781, prior development low 4762, and 4746.

Resistance: 4815/16, 4822, 4829/33, 4840, 4846, 4850, 4855, 4861/63, 4868

Support: 4804, 4796, 4781, 4771, 4762, 4750, 4746, 4739/37, 4724

Value Area Levels (Source Bloomberg)

Previous SYCOM and Day Session 4835 to 4875

Overnight Session Closed 4794 to 4832

Have a good day.

Aliom Pty Limited (ACN 123 876 291 AFSL 323182) does not warrant the accuracy, completeness or correctness of any information herein. In preparing this post, Aliom Pty Limited has not taken into account the investment objectives, financial situation or particular needs of any particular person. Before making an investment decision on the basis of information in this post you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult a licenced advisor or accountant to assist your decision.

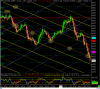

The SPI200 March 10 contract continued to trade within the development yesterday, rotating to 4892 in the opening phase to then rotate lower inside the development through the course of the session. An initiating sell tail triggered at 4841 late in the session to close at 4837.

The market developed in a 4817 to 4840 range in the first half of the night session. An early morning distribution extended the market lower to a rejecting responsive buy tail at 4781, that rotated the market higher to 4796 initially, then 4816 to close at 4810.

The market has made a new distribution lower overnight, with a temporary low now in place at the responsive sell tail 4781. The double distribution lower overnight indicates a bearish bias.

Key resistance is initially at 4815/16, 4822, prior development low 4829/33 and 4950/52.

Key support is initially at 4796, 4781, prior development low 4762, and 4746.

Resistance: 4815/16, 4822, 4829/33, 4840, 4846, 4850, 4855, 4861/63, 4868

Support: 4804, 4796, 4781, 4771, 4762, 4750, 4746, 4739/37, 4724

Value Area Levels (Source Bloomberg)

Previous SYCOM and Day Session 4835 to 4875

Overnight Session Closed 4794 to 4832

Have a good day.

Aliom Pty Limited (ACN 123 876 291 AFSL 323182) does not warrant the accuracy, completeness or correctness of any information herein. In preparing this post, Aliom Pty Limited has not taken into account the investment objectives, financial situation or particular needs of any particular person. Before making an investment decision on the basis of information in this post you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult a licenced advisor or accountant to assist your decision.