Hey ac or GMS, wondering if I could I get your comment on some hypothetical market psychology.

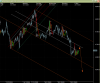

I'm no pitchfork expert but I added these lines where it looked logical.

My thinking is that if we break the middle orange line, then we're probably breaking out of the current daily range, and it's a long way down from there. However in shorting the R3 line near the close, I was worried about a play back to the R2 line as it did on the open.

This question might be nonsensical as it hasn't actually played out and I know diddly about market participants, but if we were going to break lower, is there any logic to thinking that "They'd" want to shake out the shorts before doing so and buy it up 10 points to R2 first?

The spike up at open seemed to be testing the overnight value, but I can't see that there's anything left to test by a move to R2 again.

Of course I have no notion of who 'They' are or if 'They' exist.

I'm interested in the intentions behind market movements and just wondered if you could offer an opinion on that scenario or at least confirm my idiocy on market mechanics.

Cheers,

Jules.

I'm no pitchfork expert but I added these lines where it looked logical.

My thinking is that if we break the middle orange line, then we're probably breaking out of the current daily range, and it's a long way down from there. However in shorting the R3 line near the close, I was worried about a play back to the R2 line as it did on the open.

This question might be nonsensical as it hasn't actually played out and I know diddly about market participants, but if we were going to break lower, is there any logic to thinking that "They'd" want to shake out the shorts before doing so and buy it up 10 points to R2 first?

The spike up at open seemed to be testing the overnight value, but I can't see that there's anything left to test by a move to R2 again.

Of course I have no notion of who 'They' are or if 'They' exist.

I'm interested in the intentions behind market movements and just wondered if you could offer an opinion on that scenario or at least confirm my idiocy on market mechanics.

Cheers,

Jules.