tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

Barney

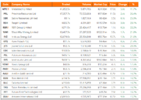

I often find great prospects from snaps through IB

but a quick look at the charts culls 90% of them.

I think there are ways of developing a watchlist from them.

technically you could certainly have some conditions.

I often find great prospects from snaps through IB

but a quick look at the charts culls 90% of them.

I think there are ways of developing a watchlist from them.

technically you could certainly have some conditions.