- Joined

- 20 July 2021

- Posts

- 11,730

- Reactions

- 16,357

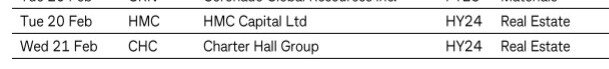

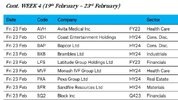

only speculation on my part butHere's a weird but wonderful outlook of the ASX for the future. They seem pretty keen on it rising 21.8% by the end of 2024. Something I can't quite get my head around. and to me is highly unlikely. Heads up for obtrusion. I got no idea what they base it on?

View attachment 171114View attachment 171115

ASX 200 FORECAST 2025, 2026, 2027-2029

ASX 200 forecast and predictions for 2025, 2026, 2027, 2028 and 2029. The latest ASX 200 prediction for each month: open, maximum, minimum and close levels. ASX index outlook for years.longforecast.com

maybe they forecast wage rises , that will partly flow into Super/ETFs especially now some funds are moving away from 'green-investing

the May bump this year may be 'vote buying policies' by governments local and international propping up investor confidence ( or so they hope )

'