Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,388

- Reactions

- 22,372

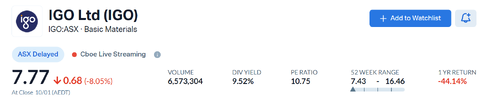

too far too soon? been a good run to date...Market Index Morning Wrap - The start of another week.

Morning Wrap: ASX 200 to fall, S&P 500 logs seventh straight week of gains

ASX 200 futures are trading 74 points lower, down 1.00% as of 8:20 am AEDT.www.marketindex.com.au

"The Dow Jones Industrial Average closed higher Friday after a whipsaw session, where it marked a fresh intraday record, and the tech-heavy Nasdaq-100 set a record close.

....S&P 500 logged its seventh straight week of gains, market analysts are increasingly worried about overbought conditions...