- Joined

- 16 June 2005

- Posts

- 4,281

- Reactions

- 6

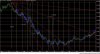

Thought I would start a new thread to keep the charts together. This is my version of analysing time and was inspired by Gann's book "How to make profits in Commodities" where he says to measure time in ranges, tops to tops and lows to lows - or something along those lines as my copy of the book is packed away in storage at the moment.

To gain this knowledge from courses was a hefty price when I started a number of years ago. So, I observed the markets myself and saw what happened. I consider myself a beginner in time analysis and my version of it may not be conventional - lol.

IMO, time analysis seems to be one of the mysterious things about Gann techniques. Other than time (and astro analysis which I haven't learnt), most other price and volume analysis that Gann appeared to use are mostly familiar to us. So will share my version of time analysis in the hopes of clearing up some of the mystery.

I am not a Gann expert and the methods I use are not a holy grail. It doesn't always work perfectly - same as with most other analysis. Gann was big on the use of stop losses so he obviously didn't have a never fail system either. However, when the time counts come in close to the time the charts are also showing a potential turning point, it gives a bit more confidence to take the trade. It gives both x and y coordinates on the chart which can be helpful.

I personally don't use it for forecasting - I like to see what the markets are providing when that time arrives and then look for confirmation in price, volume, chart patterns, etc. My general rule of thumb is that time is likely to reverse the market - so if the market is trading in a reaction, it is likely to turn back with the trend. If it is trending and hitting important price levels, it is possible that it will reverse around that time. It may not necessarily be a major turn - and sometimes it will only pause the market.

The simple calendar day counts I am showing on the charts were originally based on SPI futures, but due to the difficulty of getting SPI eod charts, I am showing them on the XJO.

A couple of these charts were posted on this thread: https://www.aussiestockforums.com/forums/showthread.php?t=13871&page=2 and started on post #357. Anyone interested can follow up on the discussions on the other thread.

Would be grateful if any others using time analysis would also post their methods so we can all learn...

Below is the first chart which was originally posted on the 3rd may and shows that the XJO was running in 21 calendar cycles at that time.

To gain this knowledge from courses was a hefty price when I started a number of years ago. So, I observed the markets myself and saw what happened. I consider myself a beginner in time analysis and my version of it may not be conventional - lol.

IMO, time analysis seems to be one of the mysterious things about Gann techniques. Other than time (and astro analysis which I haven't learnt), most other price and volume analysis that Gann appeared to use are mostly familiar to us. So will share my version of time analysis in the hopes of clearing up some of the mystery.

I am not a Gann expert and the methods I use are not a holy grail. It doesn't always work perfectly - same as with most other analysis. Gann was big on the use of stop losses so he obviously didn't have a never fail system either. However, when the time counts come in close to the time the charts are also showing a potential turning point, it gives a bit more confidence to take the trade. It gives both x and y coordinates on the chart which can be helpful.

I personally don't use it for forecasting - I like to see what the markets are providing when that time arrives and then look for confirmation in price, volume, chart patterns, etc. My general rule of thumb is that time is likely to reverse the market - so if the market is trading in a reaction, it is likely to turn back with the trend. If it is trending and hitting important price levels, it is possible that it will reverse around that time. It may not necessarily be a major turn - and sometimes it will only pause the market.

The simple calendar day counts I am showing on the charts were originally based on SPI futures, but due to the difficulty of getting SPI eod charts, I am showing them on the XJO.

A couple of these charts were posted on this thread: https://www.aussiestockforums.com/forums/showthread.php?t=13871&page=2 and started on post #357. Anyone interested can follow up on the discussions on the other thread.

Would be grateful if any others using time analysis would also post their methods so we can all learn...

Below is the first chart which was originally posted on the 3rd may and shows that the XJO was running in 21 calendar cycles at that time.