- Joined

- 12 November 2007

- Posts

- 1,629

- Reactions

- 47

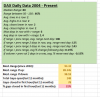

Yeah I've made some stuff ups, the gap figures don't make sense to me. I have done if open > or < previous close, but need to modify it more as I think I've done the wrong parameters, as I said before this is just the stuff I'm TRYING to work on so don't go off my figures/findings, but more of it is learning excel and thinking straight about what I'm trying to calculate, can turn into a bit of Inception sometimes