Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 9,956

- Reactions

- 7,053

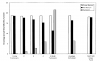

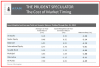

This is great info and follows closely the results reported from people I know in the industry and studies that have been done.

I note around 50% have + or - $100 ---I figure a large majority of these would not be trading at all.

Infact I believe most accounts are dormant with many brokers.

This is an interesting read.

http://www.uts.edu.au/sites/default/files/PaperGallagherDavid.pdf

As is this.

http://www.travismorien.com/FAQ/trading/futradersuccess.htm

I like this quote from the second document you quoted.

Conclusions of this study: the great majority of traders surveyed had a risk of ruin so high as to make eventual bankruptcy virtually inevitable. The traders with the shortest time frames (day traders) lost the most money and had the highest risk of ruin.

I know a few very serious successful investors and none of them are day traders. I have learnt from my own history that I do best if I undertake trades with a long term focus. Day trading on high margin - a sure way to lose your capital.