- Joined

- 8 June 2008

- Posts

- 13,244

- Reactions

- 19,549

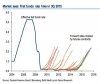

interesting entry by wysiwyg

https://www.aussiestockforums.com/forums/showthread.php?t=13317&page=3

I suppose the debate/definition of services can go there if anyone wants to add their views

https://www.aussiestockforums.com/forums/showthread.php?t=13317&page=3

I suppose the debate/definition of services can go there if anyone wants to add their views

, because most will be shocked by what's coming after that.

, because most will be shocked by what's coming after that.