DeepState

Multi-Strategy, Quant and Fundamental

- Joined

- 30 March 2014

- Posts

- 1,615

- Reactions

- 81

Quick trip through recent history.

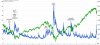

Stress spikes vs SP500 index levels.

These recent ructions have something in common with the 2010 spike. At that time, there really was nothing specific which spooked the market. Lists of concerns at the time:

+ China property hard landing;

+ US recovery not particularly strong;

+ Germany bans short selling...

EPS forward looking revisions have not moved very much in recent times. Approx 1% downward for next 12 months in ASX, Europe and pretty flat in the US.

Credit markets are not generally as rattled as they were in 2011 although Emerging markets CDS spreads are elevated.

Yet another China wobble leading to poor sentiment? Yet China estimates are still fairly flat:

Tentative conclusions? Buying opportunity? Or China is toppling....bringing commodities down...bringing EM down...bringing world growth down....

Stress spikes vs SP500 index levels.

These recent ructions have something in common with the 2010 spike. At that time, there really was nothing specific which spooked the market. Lists of concerns at the time:

+ China property hard landing;

+ US recovery not particularly strong;

+ Germany bans short selling...

EPS forward looking revisions have not moved very much in recent times. Approx 1% downward for next 12 months in ASX, Europe and pretty flat in the US.

Credit markets are not generally as rattled as they were in 2011 although Emerging markets CDS spreads are elevated.

Yet another China wobble leading to poor sentiment? Yet China estimates are still fairly flat:

Tentative conclusions? Buying opportunity? Or China is toppling....bringing commodities down...bringing EM down...bringing world growth down....