FWIW I'm still using the September contract (as I assume you are to) which is 'U'. It confuses me you keep referring to it as "Z" but I'm sure there's another reason for that.

Minor technical difficulties aside,

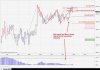

Not sure what to expect today, Equities markets well bid on the back of the china pmi + Syria 'no bombing for now' talk and I can see the FTSE fut's up 50 or so points since sat mornings close. Probably expecting it push up a little more on the open and then settled down. labor day in the USA tonight so I can't imagine things would get too crazy.

Gotta react not predict though!

Z is the FTSE contract code when using IB, so that might be why?