- Joined

- 14 December 2010

- Posts

- 3,472

- Reactions

- 248

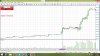

Exited 2nd SPI contract for 100 points.

Global markets not showing any weakness yet. Too much of a gamble to hold now. I got in expecting other markets to correct to the downside. Hasn't happened.

Global markets not showing any weakness yet. Too much of a gamble to hold now. I got in expecting other markets to correct to the downside. Hasn't happened.