MichaelD

Not fooled by randomness

- Joined

- 7 December 2005

- Posts

- 912

- Reactions

- 2

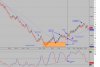

Shaping up to be another "maximum pain for maximum participants" day.

Stop run on the open to hurt the remaining bottom pickers.

Then a big, quick reversal to go back over previous support to hurt the shorters.

Once again, several quick in-outs with very small size is the only way to safely play.

Stop run on the open to hurt the remaining bottom pickers.

Then a big, quick reversal to go back over previous support to hurt the shorters.

Once again, several quick in-outs with very small size is the only way to safely play.