This is huge at the moment.Spending on experiences

Could literally throw a couple of coloured LEDs round my yard and charge an entrance fee for it.

This is huge at the moment.Spending on experiences

AWESOME ! added some extra MYS last week , might have snagged another goerTodays retail sales out from ABS

View attachment 164912

View attachment 164913

View attachment 164915

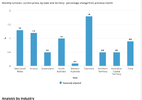

This last chart does not look like an increase in "experience" to me.

department stores a surprise, the lack of growth in cafes restaurants and takeaways an even bigger surprise.

View attachment 164916

And a look at where it is all happening shows up more surprises

Tasmania the largest increase by far, NSW Vic and South Oz ahead of the pack.

WA, QLD NT and ACT pulling it back.

Bodes ill for the QLD Labour Government election.

Mick

EDITED Forgot to mention that it makes a bit more of a case for another rate increase by the RBA.

Too much demand. Labor needs to cut immigration, but that would cause other problems (probably run hotter). Rental vacancies were running at something like 1% I think. Need another black swan to swat them down. Talk of more "boom" next year.House sales are still extremely high, and prices ridiculously high.

I've been waiting for the 'inevitable' fall in the housing market, but the cobwebs are getting so thick I'm losing sight of the end game.

A couple of years ago, my wife and I sold one of our investment properties to our son and partner at, current market value, 50% discount so that we can all be in the same neighbourhood. Now it's my daughters turn, and we are doing the same for her. We're losing a big chunk of what we could have made with the properties, but for us family is priority. Besides that, we are still comfortable and if anything happens to us, we are moving in with the kids

The past week we have been actively looking for another investment property, it is a healthy market. However, I am seeing other sections of the economy slowing.

I wish I had a crystal ball that worked.

My thesis is that older people have money because cash rate has risen and they use department stores.Todays retail sales out from ABS

View attachment 164912

View attachment 164913

View attachment 164915

This last chart does not look like an increase in "experience" to me.

department stores a surprise, the lack of growth in cafes restaurants and takeaways an even bigger surprise.

View attachment 164916

And a look at where it is all happening shows up more surprises

Tasmania the largest increase by far, NSW Vic and South Oz ahead of the pack.

WA, QLD NT and ACT pulling it back.

Bodes ill for the QLD Labour Government election.

Mick

EDITED Forgot to mention that it makes a bit more of a case for another rate increase by the RBA.

Gisborne located near Melbourne is seeing big property price falls. At least $100,000 on previously 900k properties. If its not prime investment then it is falling.House sales are still extremely high, and prices ridiculously high.

I've been waiting for the 'inevitable' fall in the housing market, but the cobwebs are getting so thick I'm losing sight of the end game.

A couple of years ago, my wife and I sold one of our investment properties to our son and partner at, current market value, 50% discount so that we can all be in the same neighbourhood. Now it's my daughters turn, and we are doing the same for her. We're losing a big chunk of what we could have made with the properties, but for us family is priority. Besides that, we are still comfortable and if anything happens to us, we are moving in with the kids

The past week we have been actively looking for another investment property, it is a healthy market. However, I am seeing other sections of the economy slowing.

I wish I had a crystal ball that worked.

I hear rather a lot of comments to the effect young people have simply given up on home ownership and also have no intention of self-funded retirement.But considering no one can afford a house I guess its live and let live.

Gisborne located near Melbourne is seeing big property price falls. At least $100,000 on previously 900k properties. If its not prime investment then it is falling.

Cruises are booking out a year ahead, baby boomers have been demonised for the last few years, plus they have lost a couple of their healthy years travel with covid, so they are booking ahead to make sure they have their bucket list ticked.Having to do "family activities" the "experience" sector looks to be booming from a street level glance.

Circus.

Led lights in different settings.

Pick your own fruit.

Adventure.

Shows (eg recent dinosaur show at Sydney)

I think there's a price point it has to come under. Also a time limit to how long it takes. But it seems to be churning some coin. I talk to a lot of operators and they seem to think it's booming.

Shuss don't mention death duties to loudly or some bum polisher in Canberra might thinkit is a good idea.Cruises are booking out a year ahead, baby boomers have been demonised for the last few years, plus they have lost a couple of their healthy years travel with covid, so they are booking ahead to make sure they have their bucket list ticked.

Most I talk to say, to hell with, I'm doing it while I can, the kids inheritance is getting hammered, which will please the Govt.

It's hard enough to get workers now, it will be impossible when the kids get their parents house.

Death duties anyone?

Politically impossible.Death duties anyone?

Yeah I guess trying death duties on the peasants would be political suicide.Politically impossible.

But it may well be economically unavoidable, that's the real problem.Politically impossible.

How about the top end of town being caught up with and the Taxation Department doing the right thing and chasing them down to pay their fair proportion of tax.But it may well be economically unavoidable, that's the real problem.

It was the same conundrum that faced both Keating and Howard, with regard the introduction of the gst and now as then options are becoming limited.

Lowering personal tax rates, refusing to increase the gst rate and coverage, it is all leading to limited options to increase the tax take, just using inflation is crucifying middle Australia.

So importing more skilled workers, which in turn erodes middle Australias wages, just accelerates the slide back to the 1960's.

Well the ACTU, meantioned it was preferable to some other mentioned taxes, as death duties doesn't put the burden on those who have worked all their lives to achieve financial independance, which is actually what the Governments wants.Yeah I guess trying death duties on the peasants would be political suicide.

But would Albo be that dumb or smart.

You have to remember most politicians fall into that financial demographic, so it isn't very likely they will be too aggressive reigning it in, much easier just to screw the middle class.How about the top end of town being caught up with and the Taxation Department doing the right thing and chasing them down to pay their fair proportion of tax.

Saw on the TV news a couple of nights ago about just how many billions this area gets away with.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.