You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The official "ASX is tanking!" panic thread

- Thread starter RexBudman

- Start date

-

- Tags

- asx asx tanking panic

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

The Greeks don't have the Centrelink benefits we have here(only a pension of $300-$400 euro's a month in their 50's) but they do have a high public service force that needs to cut back as they cannot sustain that at present.

I suppose they really don't need Centrelink, all you have to do is work in a "dangerous job" for a few years and you are set.

Read down through the second, third and fourth para of this...

http://chasblogspot.blogspot.com/2010/05/why-greece-is-in-trouble-and-warning.html

I suppose they really don't need Centrelink, all you have to do is work in a "dangerous job" for a few years and you are set.

Read down through the second, third and fourth para of this...

http://chasblogspot.blogspot.com/2010/05/why-greece-is-in-trouble-and-warning.html

Unfortunately there are parts of our society that has this attitude too.

I agree there is a problem with expecting to much from the Government and there are alot of areas, believe me, that Greece needs to fix up. But what is happening in Greece now has also alot to do with corrupt Governments and officials who have made an absolute fortune (and are not accountable)and want the average guy who ate some crumbs to pay.

I wonder if we didn't have China and the resource sector,would Australia be in the same boat? Are we heading this way?

Makes me think.

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

Unfortunately there are parts of our society that has this attitude too.

Big difference between attitude and reality, hopefully we will have an election before our attitude becomes a greek tragedy.

Got out for the night at 4,180 having sold CFD at 4,190, ended the day flat

US market rebounds again, Apple results were decent, European bail out received positive news again.

Expecting a rebound - looking at buying at the opening bell 4,242 to get out with a quick buck at 4,250.

US market rebounds again, Apple results were decent, European bail out received positive news again.

Expecting a rebound - looking at buying at the opening bell 4,242 to get out with a quick buck at 4,250.

- Joined

- 11 September 2008

- Posts

- 844

- Reactions

- 0

Got out for the night at 4,180 having sold CFD at 4,190, ended the day flat

US market rebounds again, Apple results were decent, European bail out received positive news again.

Expecting a rebound - looking at buying at the opening bell 4,242 to get out with a quick buck at 4,250.

Apple is currently down 6.3% in after hours. Coupled with Moody's doing a fresh round of downgrades (i.e Spain) the news isn't great. Let's hope this doesn't weigh on the XAO today.

Got out for the night at 4,180 having sold CFD at 4,190, ended the day flat

US market rebounds again, Apple results were decent, European bail out received positive news again.

Expecting a rebound - looking at buying at the opening bell 4,242 to get out with a quick buck at 4,250.

meh, in at 225 out at 226 was hoping for a bigger initial bounce oh well

- Joined

- 11 September 2011

- Posts

- 9

- Reactions

- 0

I suppose they really don't need Centrelink, all you have to do is work in a "dangerous job" for a few years and you are set.

Read down through the second, third and fourth para of this...

http://chasblogspot.blogspot.com/2010/05/why-greece-is-in-trouble-and-warning.html

Oh god, what a rort.

Some more food for thought. Check this. Another rort, i.e., it's embedded in the Greek constitution that public service employees cannot be dismissed.

http://www.cnbc.com/id/44944435

Let the volatility in the market continue!

Oh god, what a rort.

Some more food for thought. Check this. Another rort, i.e., it's embedded in the Greek constitution that public service employees cannot be dismissed.

http://www.cnbc.com/id/44944435

Let the volatility in the market continue!

That was a law implemented at the start of the century because people lost their jobs with each government change over. Yet at the same time the article does highlight that the Greeks work longer hours than other European members but not as efficiently... whatever that means.

The biggest problem here(IMO) is that practically all of the developed countries are in debt and they don't know how to get out of it. The biggest is the USA ($14 Trillion). And each is blaming the other without looking in their own backyard. And the media don't seem to be asking the right questions.

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

That was a law implemented at the start of the century because people lost their jobs with each government change over. Yet at the same time the article does highlight that the Greeks work longer hours than other European members but not as efficiently... whatever that means.

This is how the Greek public service grew to to the point where it is now considered a paid holiday camp and hence the level of efficiency.

Click on this link - How not to run a business

PS - This what is going on at QAN at the moment, Joyce gets a 70% pay rise and 1000 frontline staff have to go to reduce costs !!!

This is how the Greek public service grew to to the point where it is now considered a paid holiday camp and hence the level of efficiency.

Click on this link - How not to run a business

PS - This what is going on at QAN at the moment, Joyce gets a 70% pay rise and 1000 frontline staff have to go to reduce costs !!!

True.

- Joined

- 11 September 2011

- Posts

- 9

- Reactions

- 0

That was a law implemented at the start of the century because people lost their jobs with each government change over. Yet at the same time the article does highlight that the Greeks work longer hours than other European members but not as efficiently... whatever that means.: So I don't know who the writer is trying to blame.

The biggest problem here(IMO) is that practically all of the developed countries are in debt and they don't know how to get out of it. The biggest is the USA ($14 Trillion). And each is blaming the other without looking in their own backyard. And the media don't seem to be asking the right questions.

Hey Kavla

The law was implemented at the start of last century, not this century. An important distinction due to there being numerous changes of govt since without the whole public service being summarily dismissed. Therefore, why hasn't the constitution been changed? Herein lies a problem. Why would a people so reliant and dependent on government even contemplate changing the constitution. Bad, bad decision by whoever floated the notion of a guaranteed job for life.

The article does state that the Greeks who do work (lowest participation rate in all Europe) work longer hours yet produce/achieve less than their counterparts in Europe, i.e., they are less productive.

I love the reference to "white strikes" in the article. “white strikes,” when employees go to the office but don’t actually do any work.) Hilarious, just like any other day in the public service.

I do agree that corruption is rife in Greece. Teamed with a bloated public service and rampant tax evasion, it does not auger well for Greece. The pollies need to take a broad sword to the public service rather than hack at it from the periphery.

Cheers

Clifford Bennett, from Empire Economics, was just on Switzer saying how the ASX 200 will have a 100% rise to over 8000 over the next two years. Of course he gave no reasons for this sudden rise, but seriously, what world is this guy living in?

Anyone know anything about this guy? I've never heard of him before...

Anyone know anything about this guy? I've never heard of him before...

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

Probably for a good reason, Ves, given such a prediction.Anyone know anything about this guy? I've never heard of him before...

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

He's probably extending the line on the bull that ran out of puff in 2007, thinking how, longer term, crashes end up looking like Vs. With all the printing going on it's not totally silly, bigger numbers but no more valuable.

Paul Keating, the greatest, said the contraction would last for seven years at the start of the crash so it might take a bit longer.

Paul Keating, the greatest, said the contraction would last for seven years at the start of the crash so it might take a bit longer.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,797

- Reactions

- 10,574

Clifford Bennett, from Empire Economics, was just on Switzer saying how the ASX 200 will have a 100% rise to over 8000 over the next two years. Of course he gave no reasons for this sudden rise, but seriously, what world is this guy living in?

Anyone know anything about this guy? I've never heard of him before...

He used be my plumber when I lived in Florida.

He knows the S bend inside out.

http://www.manta.com/g/mt425zl/cliff-bennett

gg

- Joined

- 14 December 2009

- Posts

- 882

- Reactions

- 2

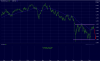

What do you think about the chances of a major retest of lows over the next week ? Right back down to theASX heading for 2 day low today? Or will the BHP takeover talks prop things up?

2 day low IMO. People have been far too optimistic re Europe as demostrated by the comments by ppl above.

bottom of the range ? Starting to look ripe!

What do you think about the chances of a major retest of lows over the next week ?

Better than average!

Market has priced in a Europe fix on sunday, anything less and we could get a huge reversal to the downside monday.

Hey Kavla

The law was implemented at the start of last century, not this century. An important distinction due to there being numerous changes of govt since without the whole public service being summarily dismissed. Therefore, why hasn't the constitution been changed? Herein lies a problem. Why would a people so reliant and dependent on government even contemplate changing the constitution. Bad, bad decision by whoever floated the notion of a guaranteed job for life.

The article does state that the Greeks who do work (lowest participation rate in all Europe) work longer hours yet produce/achieve less than their counterparts in Europe, i.e., they are less productive.

I love the reference to "white strikes" in the article. “white strikes,” when employees go to the office but don’t actually do any work.) Hilarious, just like any other day in the public service.

I do agree that corruption is rife in Greece. Teamed with a bloated public service and rampant tax evasion, it does not auger well for Greece. The pollies need to take a broad sword to the public service rather than hack at it from the periphery.

Cheers

I'm still getting my head around this century...

I guess my argument in all of this whether it's Greece or Spain or Italy etc the issues we face are Global Debt problems. (Greece really needs to eliminate this job for life clause)

If it was just one country in debt and dragging the rest down I would be the first to say "Hey clean up your act". In fact, if it was just one country, the world would ignore them and wouldn't lend to them in the first place. To compete Countries have to adapt. Look at us, we have little manufacturing left because there are cheaper alternatives world wide. Is it a good thing? Time will tell.

But the problems that will lead the global markets into freefall I believe are the debts accruing in the USA and in other developed countries. This is not the fault on one little country but of these major countries(Politicians who can't even balance their own bank accounts let alone a country) not managing their money, allowing bankers to run riot and not practicing risk management at a Global level.

Though one country can set off a chain of events that can see other countries fall over. It's all a worry.