Hello everyone - I'm kinda new here. I ran a search on Dividends and got here.

I wanted to ask a quick question, and that is; are dividend paying stocks really the best conservative means to investing for regular income? What are the real downfalls of dividends?

I don't understand dividends too much but am reading certain articles on them at the moment - though I wanted an experienced investors POV...

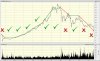

My brief stint in investing was actually not that bad, however if I had held my stocks longer, around a year, I would have gotten a huge profit - roughly 28K per every thousand dollars invested in this particular company. It was a speculative stock that really payed off, as they were 0.03 and hit 0.90 in 12 months. So I thought to myself perhaps mid/long term investing would be better, and on that note wish to know more about the real pitfalls of dividend stocks...

I wanted to ask a quick question, and that is; are dividend paying stocks really the best conservative means to investing for regular income? What are the real downfalls of dividends?

I don't understand dividends too much but am reading certain articles on them at the moment - though I wanted an experienced investors POV...

My brief stint in investing was actually not that bad, however if I had held my stocks longer, around a year, I would have gotten a huge profit - roughly 28K per every thousand dollars invested in this particular company. It was a speculative stock that really payed off, as they were 0.03 and hit 0.90 in 12 months. So I thought to myself perhaps mid/long term investing would be better, and on that note wish to know more about the real pitfalls of dividend stocks...