tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

Bill

All well and good if your holding remains at least 10%

more than your initial or accumulated purchase price.

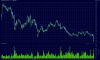

TLS was considered cheap ---- once ---- at $ 6.

Purchasing purely for dividends can be very costly

If the core holding continues to tank

A deminishing dividend doest instil confidence in the future

All well and good if your holding remains at least 10%

more than your initial or accumulated purchase price.

TLS was considered cheap ---- once ---- at $ 6.

Purchasing purely for dividends can be very costly

If the core holding continues to tank

A deminishing dividend doest instil confidence in the future