- Joined

- 3 November 2013

- Posts

- 1,570

- Reactions

- 2,776

XAO down to 6000

NASDAQ to 10000

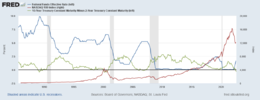

Can't edit this post, but I just threw these numbers out based on gut feel more than any "analysis". Only reason I'm bearish is because of this graph and fed rhetoric:

The 2/10 yield curve is a reliable indicator for a recession. GDP numbers in the US have been negative for the past 2 quarters (although last quarter was revised up slightly!). Inflation is turning (based on early data) but may take a while to come down to the 2% range from 8%+. Several fed governors have already publicly stated that they intend to continue hiking until inflation is well and truly defeated, even at the risk of recession - this strategy is also supported by the ECB & BoE, so there is the possibility of a global recession.

The current plan is to continue hiking until 4% and then maintain that rate for a period of time!!!! Current fed fund rate is 2.5%. There are three meetings remaining for the year. Current estimates (courtesy of the CME Fed watch tool) place a 75bps hike at 61% (v. 50bps @ 39%). Markets are estimating a rate of 3.75-4% by 14 Dec 2022 @ 85% chance. Then on top of that you've got QT (Fed previously published a note estimating its effect as the equivalent of a 25-50bps hike

So if all goes according to plan, we might peak at 4% - assuming, of course, that the Fed doesn't see the need to go further - then they'll hold for a few meetings before starting to cut. So now I return to the original graph. Market bottoms seem to coincide with whenever the Fed decides to cut, and when we're well into a recession.

So either we're in the middle of a recession right now, and the Fed will cut as early as Q1 2023, heralding a market bottom. Or as per the White House, we haven't even entered one yet and the bottom is further away

Really though, who the f&!@ knows. Nasdaq doesn't get so many -4% down days. This year, the -4% days have been during down legs, or at the very end of one i.e. early-mid June, and they're typically followed by -2% & -3% days later on. So either this is still a buy the dip scenario or we've truly started another leg down...